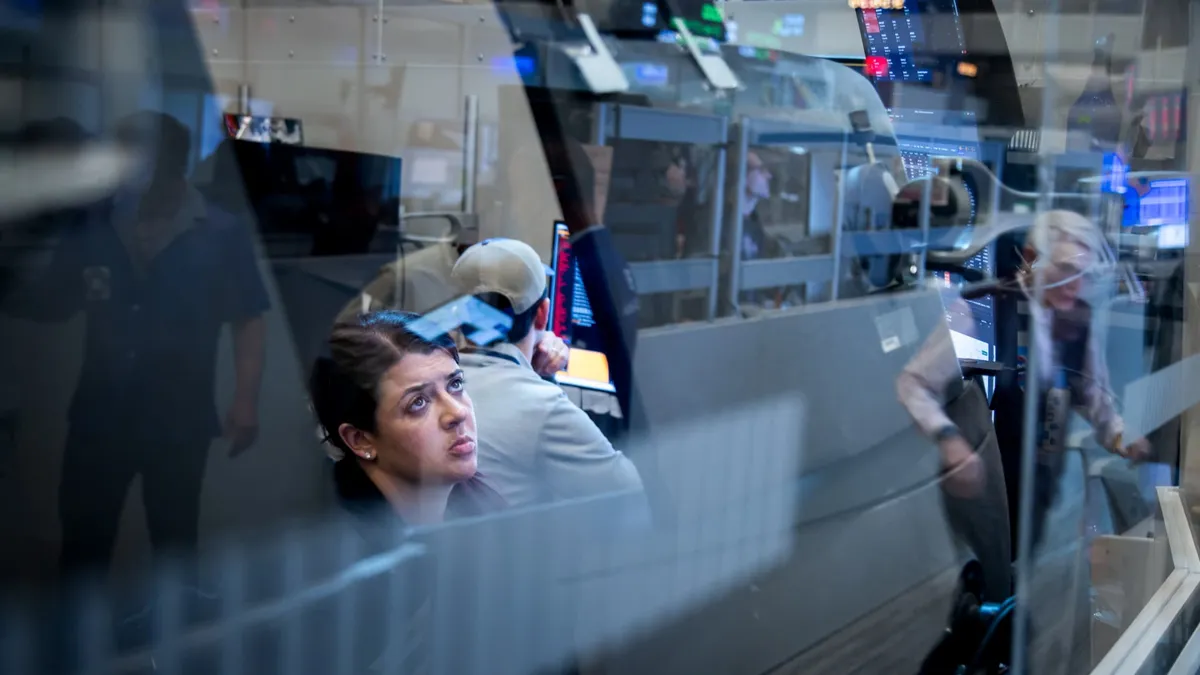

Stock futures fell on Thursday night as investors brace themselves to conclude a week marked by significant fluctuations in the markets. The S&P 500 futures dipped by 0.8%, while Nasdaq 100 futures experienced a loss of 0.9%. Additionally, futures associated with the Dow Jones Industrial Average fell by 277 points, equating to a 0.7% decrease.

Lingering fears surrounding tariffs continue to dominate investor concerns. Recently, President Donald Trump announced a temporary reduction in country-specific duties, setting a universal rate of 10% for most countries, with the exception of China. Goods imported from Beijing will face a staggering rate of 145%, as confirmed by a White House official to CNBC.

On Thursday, the S&P 500 fell by 3.46%, and the Dow experienced a significant drop of 1,014.79 points, or 2.5%. The tech-heavy Nasdaq Composite also ended the day lower, declining by 4.31%. These declines have erased a portion of the gains the major averages experienced on Wednesday, when Trump announced a 90-day reprieve on some of the high reciprocal tariffs, leading to the S&P 500 surging by 9.52%—its third-largest single-day gain since World War II—while the Dow skyrocketed more than 2,900 points.

As traders adopted a risk-off approach, stocks resumed their downward trajectory on Thursday, largely influenced by ongoing uncertainty regarding trade policies. Jed Ellerbroek, a portfolio manager at Argent Capital Management, highlighted that the reduced tariff level poses a significant challenge, as the three-month deadlines provide little certainty for consumers, businesses, and investors. He commented that these policies could lead the U.S. to face higher inflation, slower economic growth, and a frustrated stock market.

As it stands, here’s a breakdown of the current tariffs in place:

145% duty on all goods from China 25% tariffs targeting aluminum, automobiles, and goods from Canada and Mexico not covered under the United States-Mexico-Canada Agreement 10% levy on all other importsDespite the tumultuous week, the three major averages are on track for considerable gains. The S&P 500 is projected to achieve a 3.8% increase, marking its best weekly performance since November. The Nasdaq is expected to gain 5.1%, and the Dow is on pace for a 3.3% jump week-to-date.

Looking ahead, investors are turning their attention to a series of earnings reports set to be released on Friday from some of the nation's largest banks and financial institutions. This will kick off the first-quarter earnings season and provide valuable insights into the state of the U.S. economy. Major companies such as Morgan Stanley, Wells Fargo, JPMorgan Chase, and BlackRock are among those scheduled to report their financial results.

In addition to earnings reports, Friday will also see the release of key economic indicators, including the March producer price index report and the preliminary University of Michigan consumer sentiment data for April. These reports will be closely monitored by investors for further insights into economic trends.