On Monday, European defense stocks experienced a significant surge as leaders across the region pledged to shoulder the responsibility of defending Ukraine against Russia. This rally in the defense sector comes at a crucial time, as the ongoing three-year conflict seems poised to enter a new phase. The surge was notably influenced by a recent diplomatic spat that saw President Volodymyr Zelensky of Ukraine falling out of favor with President Trump.

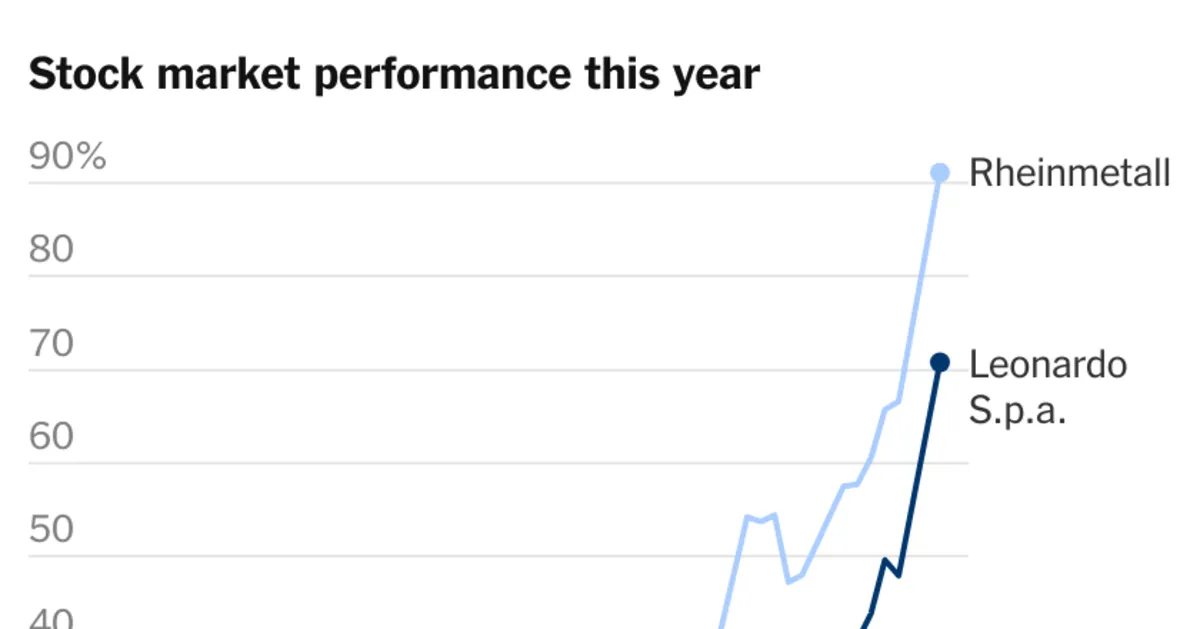

Shares of major European defense contractors, including the British firm BAE Systems, the German manufacturer Rheinmetall, and the Italian aerospace and defense giant Leonardo, reached record highs on Monday. This impressive performance has not only bolstered the defense industry but has also contributed to the rise of the Stoxx Europe 600 index, which has historically been dominated by luxury stocks.

Despite the excitement in the market, serious questions loom regarding Europe's ability to sustain increased military spending. With many nations grappling with high debt levels, chronically low economic growth, and potential tariffs introduced by the Trump administration, the financial viability of escalating military expenditures is under scrutiny. Ending the ongoing Russia-Ukraine war could come with a hefty price tag, raising concerns among European leaders.

At a recent gathering of European leaders, British Prime Minister Keir Starmer unveiled a comprehensive four-point plan aimed at reinforcing support for Ukraine. Central to this proposal is the formation of an Anglo-French coalition that would be prepared to defend any future agreements concerning Ukraine, potentially involving "boots on the ground and planes in the air." Additionally, the UK has committed to providing 2.26 billion pounds (approximately $2.86 billion) in military aid to bolster Ukraine’s defense capabilities.

Even prior to the summit, credit rating agencies had raised alarms regarding Europe's financial stability. Fitch Ratings highlighted that increasing NATO members' military spending to 3% of their GDP—while still below Trump's desired 5%—could necessitate unpopular budget cuts that may undermine social safety nets. Alternatives for financing increased military spending could include relaxing fiscal constraints, reallocating unspent post-pandemic recovery funds for defense purposes, or even raising taxes.

Investor sentiment appears cautious as yields on European bonds edged higher on Monday, signaling growing unease over potential public spending increases in an already slowing economy. Analysts remain divided on how these military commitments might impact the European Central Bank's plans to adjust interest rates, with a crucial meeting scheduled for later this week.

The situation is precarious; failing to adequately support Ukraine could force European nations into accepting a settlement that favors President Vladimir Putin of Russia. Such an outcome could challenge the cohesion of the European bloc and might be welcomed by factions that prefer a divided Europe. The stakes are undeniably high, and the coming weeks will be critical in determining the future of both European defense policy and the ongoing conflict in Ukraine.