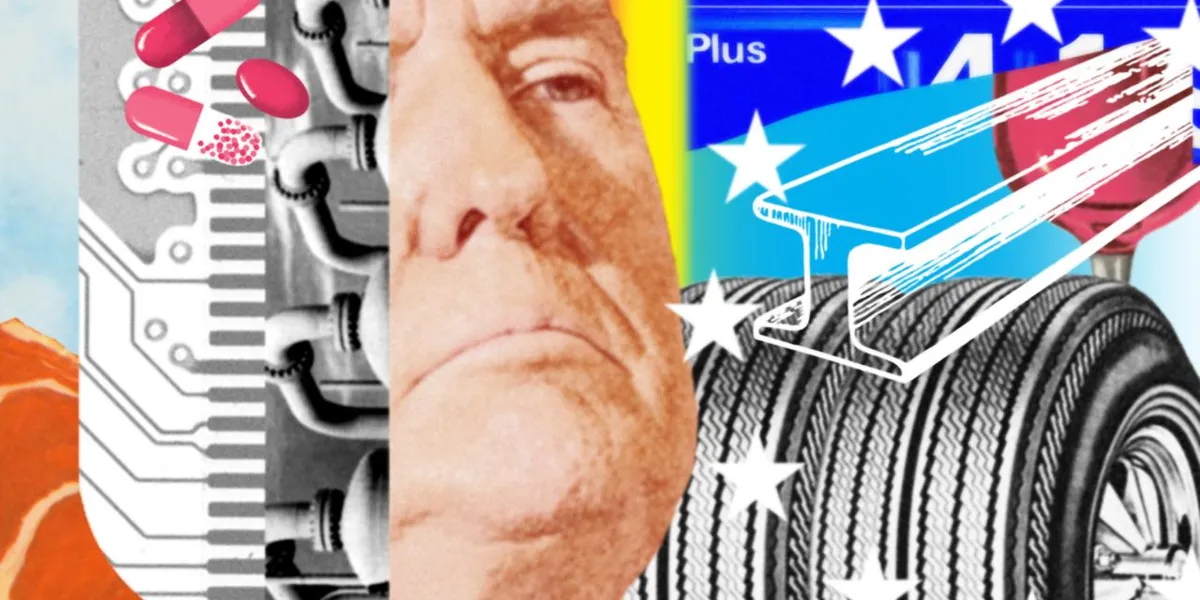

On Wednesday morning, stock futures showed a notable increase, driven by a sense of relief regarding the Federal Reserve and easing U.S.-China trade tensions. The market sentiment improved significantly following President Trump's recent remarks, which indicated he has no plans to dismiss Fed Chair Jerome Powell. This comes after his earlier comments suggesting that Powell's termination couldn't come soon enough.

In addition to addressing the Fed, President Trump stated that his 145% tariffs on China will be significantly reduced. This announcement has played a crucial role in boosting investor confidence. Furthermore, Treasury Secretary Scott Bessent expressed optimism, indicating that he believes a trade deal with China is within reach. This positive outlook was further supported by Beijing’s response, which hinted that they are open to resuming trade talks, albeit not under pressure.

Following these developments, futures linked to major U.S. indexes saw a substantial rise, with Nasdaq-100 contracts leading the way. Simultaneously, Treasurys rallied, resulting in a decrease in benchmark 10-year yields, which is often viewed as a sign of investor confidence. The U.S. dollar remained steady throughout the trading session, indicating stability in the foreign exchange market.

In the cryptocurrency arena, Bitcoin continued its upward trajectory, trading above the $94,000 mark. This surge in Bitcoin's value reflects growing interest and investment in digital currencies. Meanwhile, several major companies are set to release their earnings reports, including Boeing, GE Vernova, NextEra, AT&T, and IBM. Investors are keenly awaiting these reports as they could provide further insights into the economic landscape.

Additionally, the preliminary purchasing managers indexes (PMIs) from S&P Global for April are scheduled to be released at 9:45 a.m. ET. These indices are critical for gauging the health of the manufacturing and services sectors and will be closely monitored by market participants.

Stay informed about market trends and developments by subscribing to our free weekday morning and evening newsletters. Enhance your understanding of the financial markets and make more informed investment decisions.