Bloomberg serves as an essential resource for business leaders and financial professionals by providing timely and accurate information. With a commitment to connecting decision makers to a dynamic network of information, people, and ideas, Bloomberg delivers critical insights into the world of finance and business news.

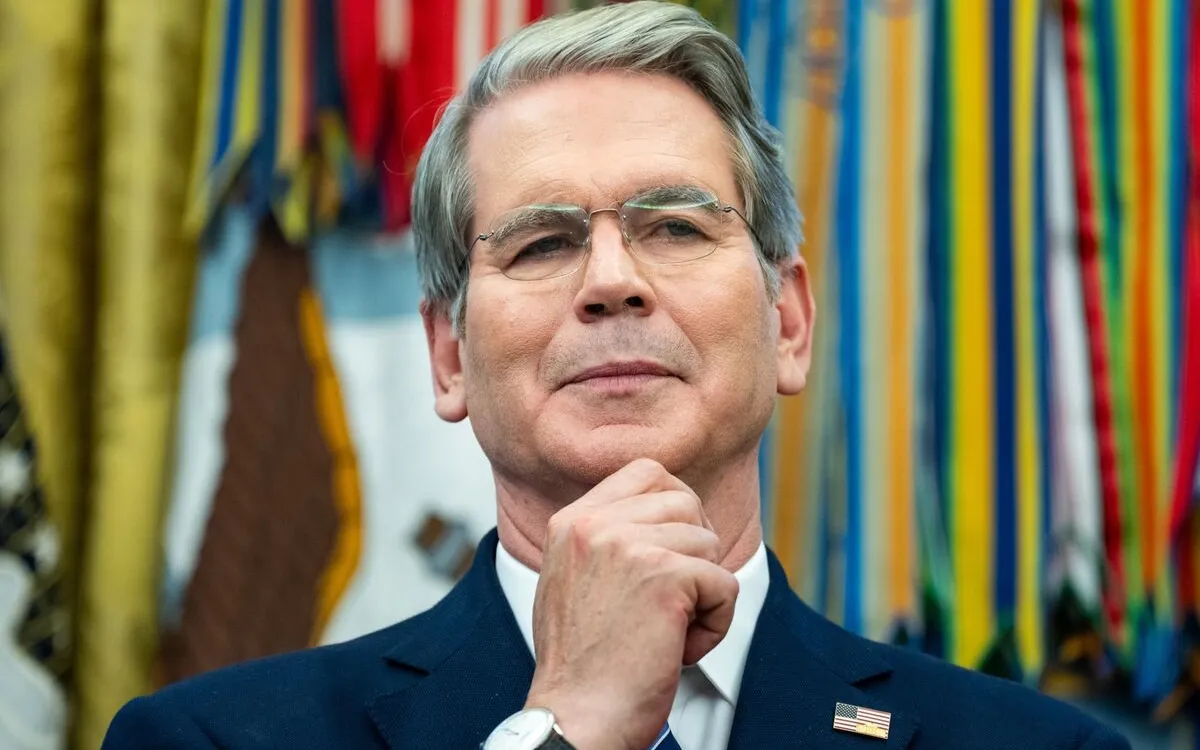

In a recent interview on Fox Business, Treasury Secretary Scott Bessent suggested that the Federal Reserve should consider a significant cut of 50 basis points in the benchmark interest rate during the upcoming meeting. This recommendation follows the Fed's decision to maintain the status quo at its last meeting, which took place on July 30.

Bessent emphasized the importance of reassessing economic indicators, particularly after revised data revealed that job growth for May and June was weaker than previously reported. This information may warrant a reconsideration of the Fed's interest rate strategy. “The real thing now to think about is should we get a 50 basis-point rate cut in September,” he stated, highlighting the significance of adapting monetary policy in response to shifting economic conditions.

A potential 50 basis-point cut could have substantial implications for the economy. It may stimulate borrowing and spending, thereby bolstering economic growth. On the other hand, it also raises concerns about inflation and long-term financial stability. As the Federal Reserve navigates these complex challenges, the insights from leaders like Bessent will play a crucial role in shaping economic policies.

As Bloomberg continues to deliver critical business and financial information, the dialogue surrounding the Federal Reserve's potential interest rate cuts remains at the forefront. The interplay between economic data, policy decisions, and market reactions will be closely monitored by stakeholders across the global financial landscape.