On Tuesday, shares of Warner Bros. Discovery (WBD) surged, reaching a 52-week high after the entertainment giant announced that its board of directors had initiated a “review of strategic alternatives to maximize shareholder value.” This development follows weeks of speculation regarding potential deals and comes just ahead of Netflix’s third-quarter earnings report.

In early trading, Netflix’s stock also hit a 52-week high of $20.58, with shares as of 1:15 p.m. ET trading up by 10.8 percent at $20.29. Warner Bros. Discovery cited “unsolicited interest” from “multiple” parties, revealing that their review could lead to various options, including a planned split and spin-off, a complete transaction for the entire company, and separate transactions for its Warner Bros. and/or Discovery Global businesses. Additionally, WBD is considering an alternative separation structure that would enable a merger of Warner Bros. while spinning off Discovery Global to shareholders.

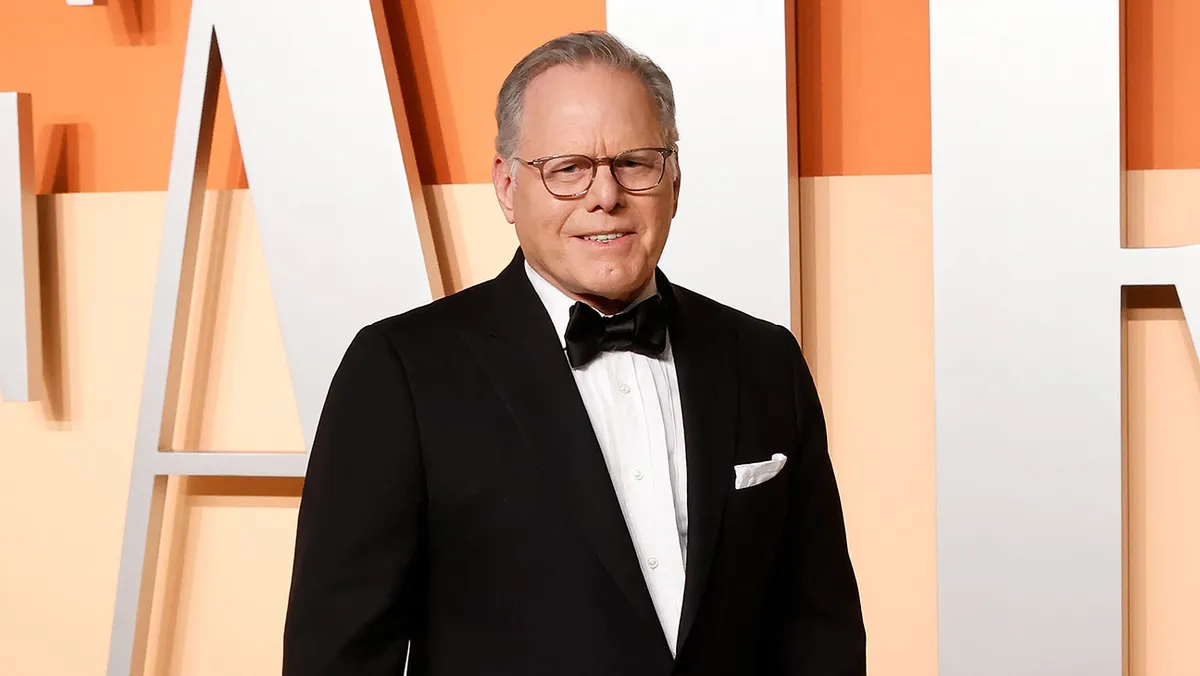

WBD indicated that there is currently no timeline for this strategic review. CEO David Zaslav remarked, “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market.”

In a reaction note, TD Cowen analyst Doug Creutz viewed the announcement as a formality, suggesting that reports had already indicated ongoing discussions with multiple parties. He speculated that a transaction involving Paramount Skydance is reasonably likely but expressed skepticism about more attractive bidders emerging.

Creutz maintains a “hold” rating on WBD with a stock price target of $14. In contrast, Benchmark analyst Matthew Harrigan raised his target from $18 to $25, reflecting confidence in the company’s potential for a higher free cash flow yield post-2025. Harrigan believes that a deal before WBD’s separation would be less expensive than a post-separation acquisition.

Bank of America analyst Jessica Reif Ehrlich reiterated her “buy” rating and set a $24 price objective on WBD. “Today’s acknowledgment of multiple unsolicited parties indicating interest in the company should provide a floor for the share price,” she stated. Reif Ehrlich noted that the wealth of premium intellectual property and a robust library makes Warner Bros. an attractive acquisition target.

She also pointed out potential deal scenarios, highlighting regulatory concerns, financial risks, and tax implications related to the previously announced split, which is structured as a tax-free transaction. It remains unclear whether unsolicited offers could pose tax risks to the planned separation.

Earlier this month, Guggenheim analyst Michael Morris raised his price target for WBD by $8, maintaining a “buy” rating. He noted that investor discussions continue to focus on the potential for a total company bid versus the planned business separation in 2026. Morris updated his valuation approach to a sum-of-the-parts methodology, resulting in a 12-month target of $22.

Robert Fishman, an analyst at MoffettNathanson, discussed potential bidders for WBD, emphasizing that a Paramount Skydance bid makes strategic sense. He highlighted the benefits of combining the linear network portfolios and the potential cost synergies from merging the platforms of HBO Max and Paramount+.

Fishman identified Comcast as an “obvious” candidate to bid for WBD, citing potential synergies in combining studios and streaming platforms. However, he noted regulatory challenges posed by the current administration. He also speculated about the possibility of a partnership with a private equity firm like Sony, although he deemed the likelihood of a bid from tech giants like Netflix, Amazon, or Apple as low.

In conclusion, analysts predict that Paramount Skydance remains the most likely candidate to succeed in acquiring Warner Bros. Discovery, given the strong strategic fit and potential benefits of such a deal.