On April 6, just days after Donald Trump announced his controversial “Liberation Day” tariffs, Treasury Secretary Scott Bessent found himself on a flight back to Washington from Mar-a-Lago. The urgency of the situation was palpable; Bessent was eager to discuss strategies for damage control. The alarming sight of Trump in the Rose Garden, brandishing placards that showcased staggering import duties reaching as high as 49%, had sent shockwaves through global markets. This bold announcement triggered the most significant two-day selloff in stocks since the onset of the pandemic.

Among the worried investors was billionaire financier Bill Ackman, who took to social media platform X to voice his concerns. In his post, he warned of an impending “economic nuclear winter,” stressing that the current trajectory could lead to catastrophic outcomes for the economy. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon echoed these sentiments, cautioning that the tariffs could reignite inflation and potentially push the economy into a recession.

Further exacerbating the situation, former Treasury Secretary Larry Summers predicted that the United States could face job losses in the millions, a dire forecast that added to the growing unease among investors. In a landscape where economic stability is paramount, the announcement of such high tariffs raised significant red flags.

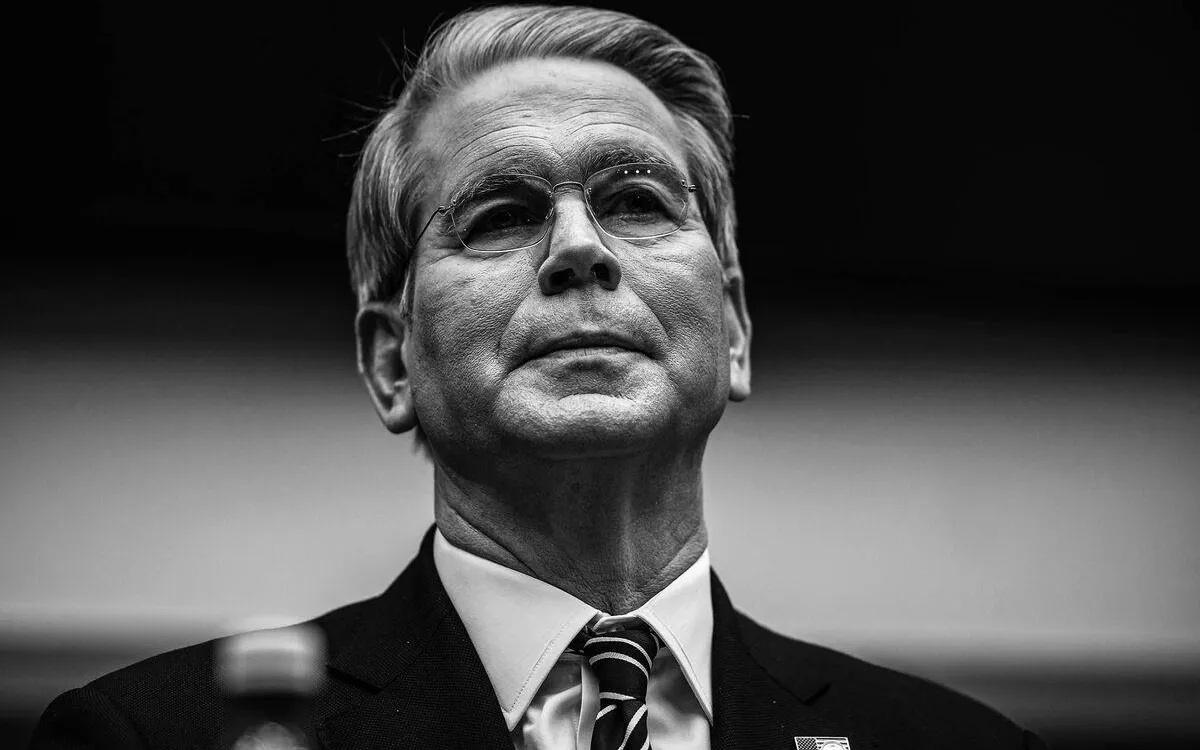

Scott Bessent, who had previously held a reputation as one of the world's leading hedge fund managers, had assured his clients just months earlier that under Trump's administration, while the “tariff gun will always be loaded and on the table,” it would rarely be discharged. In the eyes of Wall Street, Bessent was viewed as a stabilizing force—essentially the safety catch in an unpredictable economic environment. However, as the situation unfolded, many were left questioning his absence during this critical moment.

The ramifications of Trump’s “Liberation Day” tariffs are still unfolding, raising important questions about the future of U.S. trade policy and its implications for businesses and investors alike. With confidence in the U.S. as a reliable trading partner waning, stakeholders across various sectors are left to grapple with the uncertainty that these tariffs have introduced into the market.