On Thursday, President Donald Trump expressed grave concerns about a potential Supreme Court ruling that could jeopardize his administration's significant tariff policies. Speaking to reporters, he stated that losing this case would be “devastating for our country,” indicating the high stakes involved. Following a Supreme Court hearing on Wednesday, both liberal and conservative justices raised questions regarding the legality of these tariffs, suggesting that a ruling against Trump may be increasingly probable.

If the Supreme Court rules against him, Trump indicated that he would need to “develop a game two plan.” This plan could potentially limit his ability to impose tariffs formally, even as he retains several powers to do so. Uniquely among U.S. presidents, Trump has leveraged the International Emergency Economic Powers Act to implement higher tariffs. These tariffs, often referred to as “reciprocal” tariffs, have resulted in duty increases of up to 50% on key trading partners like India and Brazil, and a staggering 145% on China earlier this year.

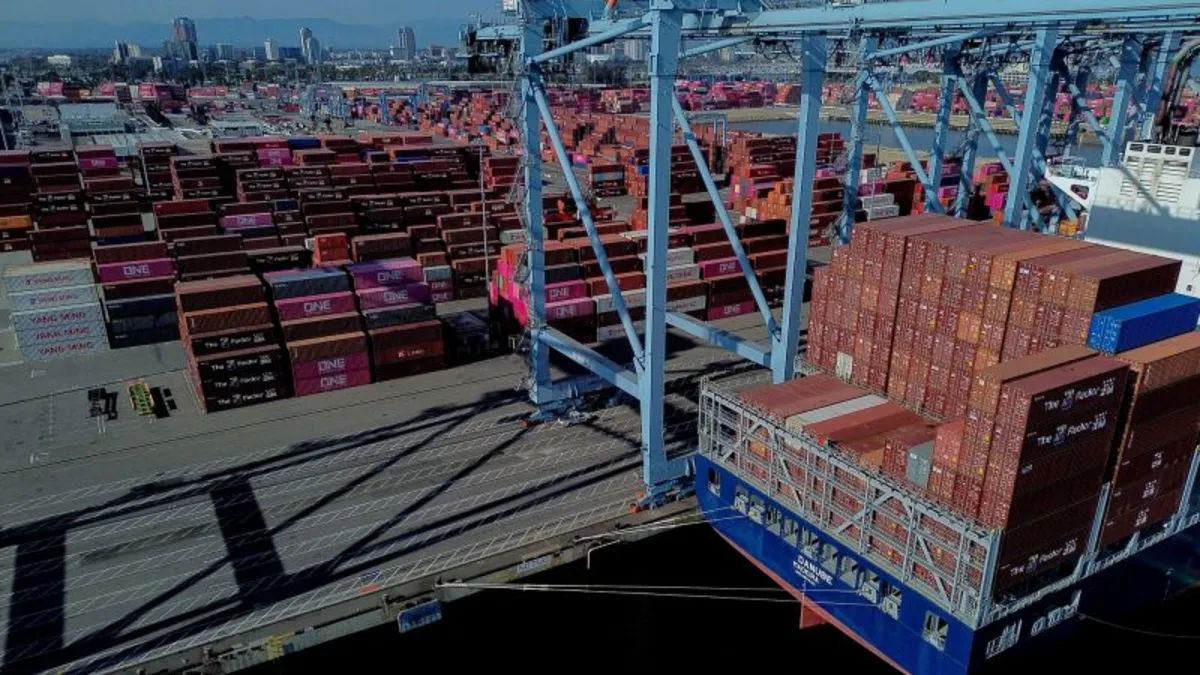

According to data from US Customs and Border Protection, these tariffs have generated nearly $90 billion in revenue from American importers as of late September. Despite the ongoing legal challenges, experts, including attorneys from the opposition, do not anticipate Trump abandoning his tariff strategy, which is central to his broader economic agenda.

Goldman Sachs economists have noted that they expect the Trump administration to employ alternative legal frameworks to maintain “substantially similar tariffs.” They emphasized that large trading partners would likely experience minimal changes in their tariff obligations, with the only difference being the legal framework under which these tariffs are applied.

Should the Supreme Court ruling limit his powers, Trump still has several avenues to impose tariffs. Here are some of the key legislative options available to him:

This section allows the president to impose tariffs of up to 15% for a maximum of 150 days to address significant U.S. balance-of-payments deficits. This can occur when the value of imports greatly exceeds that of exports, commonly referred to as a trade deficit. After the initial 150 days, Congress must approve any continuation of the levies. A critical advantage of Section 122 is that it does not require an advance investigation, enabling Trump to act swiftly to impose new tariffs on imports.

Under this provision, the president can impose tariffs on national security grounds, targeting specific sectors after a Commerce Department investigation. Trump has previously utilized Section 232 to impose tariffs on a variety of goods, including steel, aluminum, and automobiles. He has also initiated investigations into other crucial imports such as critical minerals and semiconductors.

This section empowers the U.S. Trade Representative to investigate countries that violate trade agreements or practices that are deemed “unjustifiable” and burdensome to U.S. businesses. Recently, USTR Jamieson Greer initiated an investigation into China’s adherence to a trade agreement brokered by Trump during his first term. Although this process can be lengthy, leading to tariffs without a specific cap or duration is possible under Section 301.

While never used by previous presidents, Trump could invoke this law to impose tariffs of up to 50% on imports from countries that engage in discriminatory trade practices against the United States. However, this approach could violate World Trade Organization agreements and provoke retaliation from affected nations.

As the legal landscape evolves, the Trump administration's approach to tariffs remains a critical component of its economic strategy, with various legislative options available to navigate potential challenges.