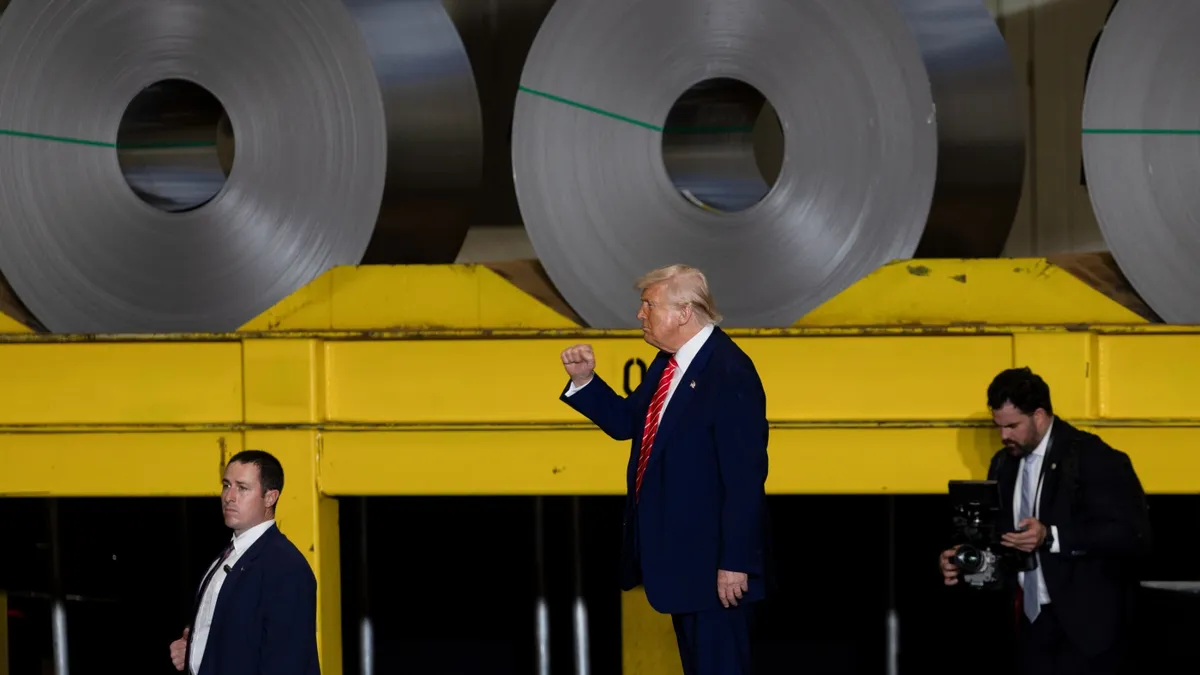

In a bold move to bolster the American manufacturing sector, President Trump has announced a significant increase in tariffs on imported steel and aluminum. Effective immediately, the tax on these imported metals has surged to 50%, doubling the previous rate. This announcement was made during a visit to a US Steel plant located just outside Pittsburgh, where President Trump addressed a crowd of steelworkers, donning hard hats. He emphasized that the new, hefty tariff would serve to protect the U.S. market from cheap foreign steel, stating, “Nobody is going to get around that.”

While the higher tariffs are anticipated to benefit domestic companies that produce steel and aluminum, it is essential to recognize the broader implications of this trade policy. For every steelworker employed in the U.S., approximately 80 workers are engaged in industries that utilize steel. As a result, the increased costs of materials may lead to higher expenses for companies relying on steel, including those in construction and manufacturing.

H.O. Woltz, who operates a company in Mount Airy, North Carolina, that manufactures steel wire for concrete reinforcement, expressed his concerns. “How are you supposed to buy the most expensive steel in the world in the United States and compete with global competitors who have access to world market pricing?” he questioned. During the first Trump administration, Woltz's business faced dual challenges: soaring raw material costs and competition from finished products from countries that did not incur tariffs. This time, the administration's approach has expanded to include taxing some finished products as well, leading to fears that construction projects may be delayed due to rising material costs.

The ramifications of these tariffs extend beyond the steel industry, affecting a multitude of sectors, including auto parts, motorcycles, and machinery. According to Katheryn Russ, an economist at the University of California, Davis, the previous steel tariffs resulted in the loss of tens of thousands of manufacturing jobs. “When there’s a tariff on steel, it drives up costs for producers who rely on steel as an input, which can lead to hiring freezes,” Russ explained. This scenario paints a concerning picture for American consumers, who may ultimately bear the brunt of these increased costs.

As tariffs climb higher and become more encompassing, consumers may soon see the impact reflected in everyday prices. Robert Budway, president of the Can Manufacturers Institute, noted that can-makers would inevitably pass increased costs onto customers, including food producers and beverage manufacturers. “It’s a lose-lose for American consumers,” Budway remarked, highlighting the cascading effect of these tariffs on various products, from canned goods to beverages.

In raising the tariffs, President Trump opted not to invoke the 1977 emergency statute that has been the basis for other tariffs currently under legal scrutiny. Instead, he referenced Section 232 of the Trade Expansion Act of 1962, which allows for tariffs under the premise of national security. Despite the potential drawbacks, some factory owners remain optimistic about the administration’s trade policies. Drew Greenblatt, a manufacturer of wire baskets and steel products, is looking to expand his operations, believing that foreign competitors will be compelled to either invest in U.S. manufacturing or source materials domestically.

However, many forecasters express skepticism regarding the long-term effects of Trump’s trade war, predicting that it could hinder overall economic growth. Woltz articulated a common concern among manufacturers: “You can build all the walls and implement all the tariffs you want, but at some point, you can't ignore the fact that the Chinese are driving the global market.”

While the intent behind these tariffs is to stimulate domestic manufacturing, a recent survey revealed that factory orders and production are being negatively impacted by the unpredictable nature of these trade policies. “Maybe Trump wakes up tomorrow and changes his mind,” Woltz said, underscoring the challenges businesses face in planning amid such uncertainty.