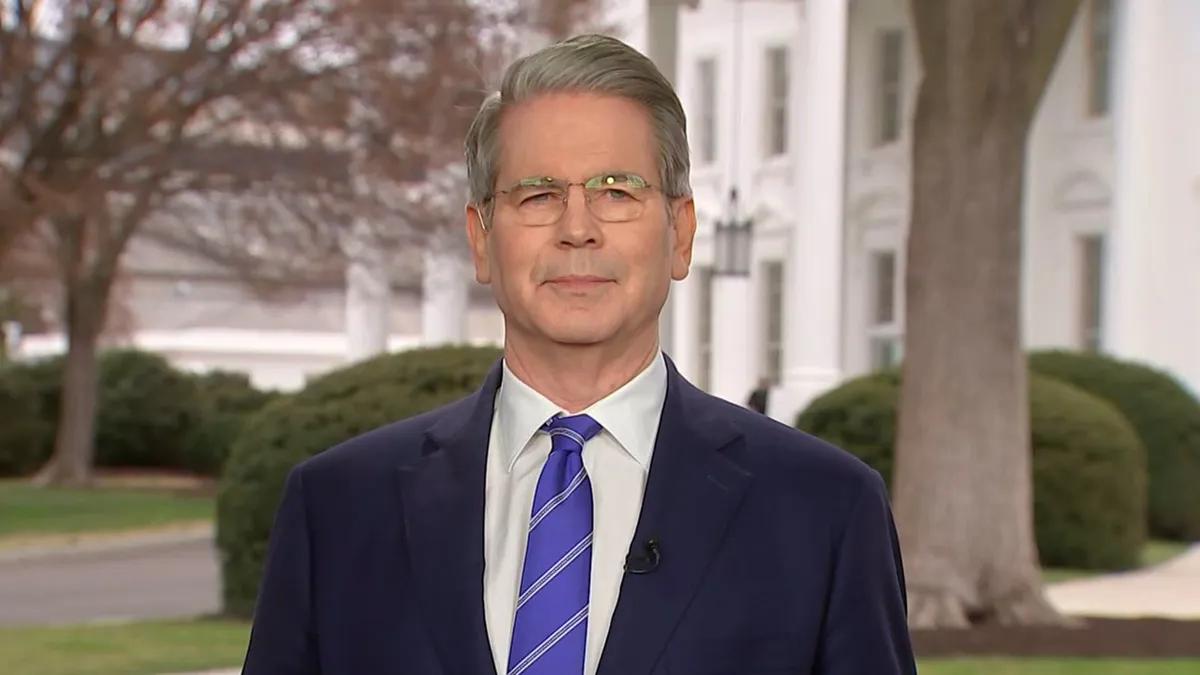

Treasury Secretary Scott Bessent emphasized the Trump administration’s commitment to averting a potential financial crisis stemming from extensive government spending over recent years. During an interview on NBC's Meet the Press, Bessent stated, “What I could guarantee is we would have had a financial crisis. I've studied it, I've taught it, and if we had kept up at these spending levels that — everything was unsustainable.” This highlights the administration's awareness of the financial challenges posed by unchecked spending.

President Donald Trump has prioritized restoring the government's fiscal health since taking office. One of the initiatives he launched is the Department of Government Efficiency, which is spearheaded by tech entrepreneur Elon Musk. This department aims to implement job cuts and offer early retirement incentives across various federal agencies to streamline operations and reduce costs.

Despite these efforts, the U.S. debt and deficit situation deteriorated during Trump's initial month in office, as February's budget shortfall surpassed the alarming $1 trillion mark. Bessent acknowledged the complexities of the current economic landscape, noting that while measures are being taken to improve the situation, there are no guarantees against a looming recession.

The financial markets have experienced significant fluctuations recently, largely due to Trump’s extensive tariff policies, which have raised apprehensions regarding inflation and a potential economic slowdown. The S&P 500 index fell into a 10% correction from its peak in February, signaling increased market volatility. Despite these concerns, Bessent maintains a positive outlook, asserting that such pullbacks are a normal part of market behavior.

Bessent, with 35 years of experience in the investment sector, believes that market corrections are healthy and essential for long-term growth. He stated, “What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis.” Reflecting on past financial crises, he remarked that intervening earlier could have prevented the economic turmoil seen in 2008.

Looking ahead, Bessent expressed confidence that if the administration implements sound tax policies, promotes deregulation, and ensures energy security, the markets will flourish. He concluded by emphasizing that a single week of market performance should not dictate broader economic sentiment, reinforcing the importance of sustained efforts for fiscal stability.