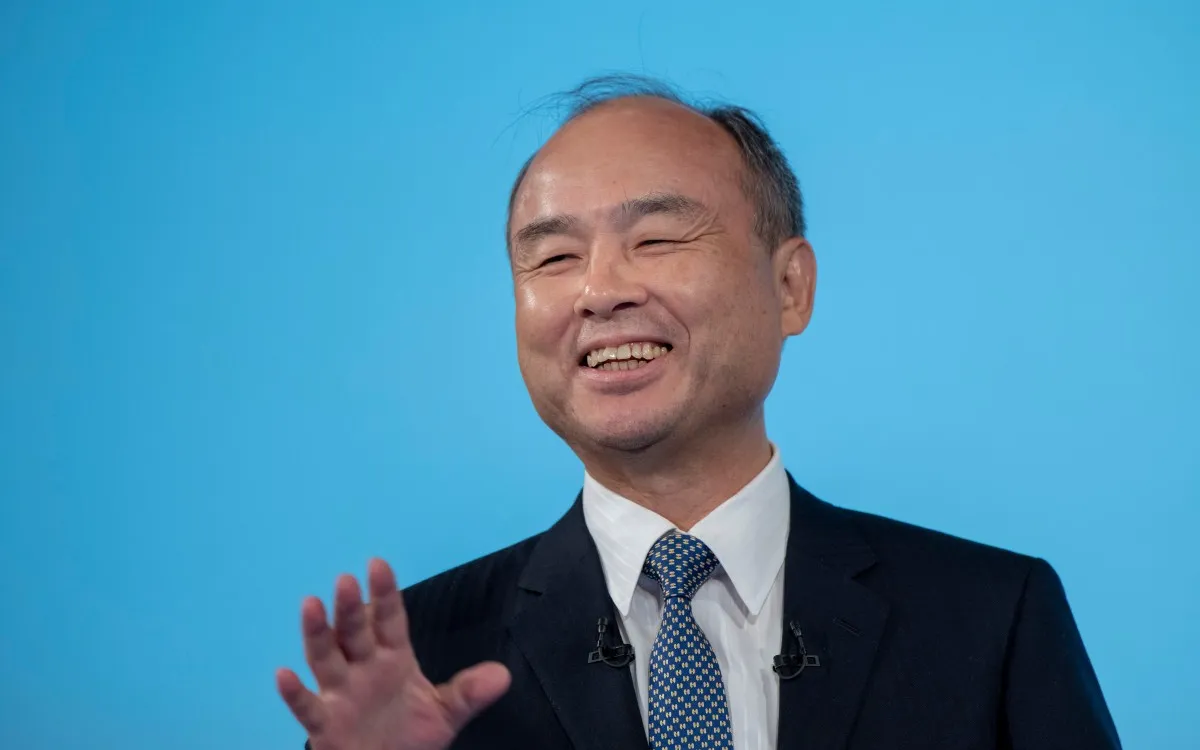

Masayoshi Son, the founder of SoftBank, is renowned for his audacious investment strategies. His career has been characterized by high-stakes bets, each more daring than the last. Recently, he surprised the business world by cashing out his entire $5.8 billion Nvidia stake, opting to go all-in on artificial intelligence (AI). While this decision raised eyebrows on Tuesday, it may not be as shocking as it seems. At this point, it’s almost more unexpected when the 68-year-old Son doesn’t take significant risks with his investments.

Reflecting on his past, during the late 1990s dot-com bubble, Son’s net worth skyrocketed to approximately $78 billion by February 2000, briefly making him the richest person in the world. However, the ensuing dot-com crash saw his fortune diminish dramatically. He lost a staggering $70 billion, marking the largest financial loss by any individual in history at that time. SoftBank’s market capitalization fell from $180 billion to a mere $2.5 billion.

Amidst this financial turmoil, Son made a monumental investment in Alibaba in 2000. His $20 million stake, decided after a mere six-minute meeting with Jack Ma, would eventually be worth an astonishing $150 billion by 2020. This pivotal investment transformed Son into a celebrated figure in the venture capital landscape and funded his remarkable comeback.

Son’s success with Alibaba often obscures his missteps. When he sought capital to launch his first Vision Fund in 2017, he sought a substantial $45 billion from Saudi Arabia’s Public Investment Fund. This decision came long before the acceptance of Saudi investments in Silicon Valley became commonplace. Following the murder of journalist Jamal Khashoggi in October 2018, Son condemned the act but maintained that SoftBank couldn't "turn our backs on the Saudi people," reaffirming the firm's commitment to managing the kingdom’s capital.

Unfortunately, the Vision Fund's performance has been mixed. A significant investment in Uber resulted in extended paper losses, while the infamous WeWork debacle has been particularly damaging. Son, enamored with WeWork’s founder Adam Neumann, assigned the co-working company an inflated valuation of $47 billion in early 2019, despite objections from his team. The company’s IPO plans collapsed after a troubling S-1 filing, leading to devastating losses for SoftBank, including $11.5 billion in equity losses and another $2.2 billion in debt. Son later described the WeWork investment as “a stain on my life.”

Son has been working on a comeback in recent years, and Tuesday's decision to sell all 32.1 million Nvidia shares may mark a turning point in his journey. Rather than diversifying his investments, he is doubling down on the future of technology, including a planned $30 billion commitment to OpenAI and participation in a proposed $1 trillion AI manufacturing hub in Arizona.

Despite the heartburn that might come from selling his Nvidia position at approximately $181.58 per share—just 14% below its all-time high of $212.19—the decision reflects Son's confidence in AI's potential. However, this marks SoftBank’s second total exit from Nvidia, following a previous loss in 2019 when SoftBank sold a $4 billion stake for just $3.6 billion. Those shares would now be valued at over $150 billion.

Following the announcement of SoftBank's exit from Nvidia, market reactions were swift, with Nvidia shares dropping nearly 3%. Analysts have emphasized that this sale should not be interpreted as a negative stance on Nvidia but rather as a strategic move to finance SoftBank’s ambitious AI goals. Wall Street is left to ponder whether Son has insights that others may overlook. Given his track record, investors remain keenly interested in what he sees in the future of AI.