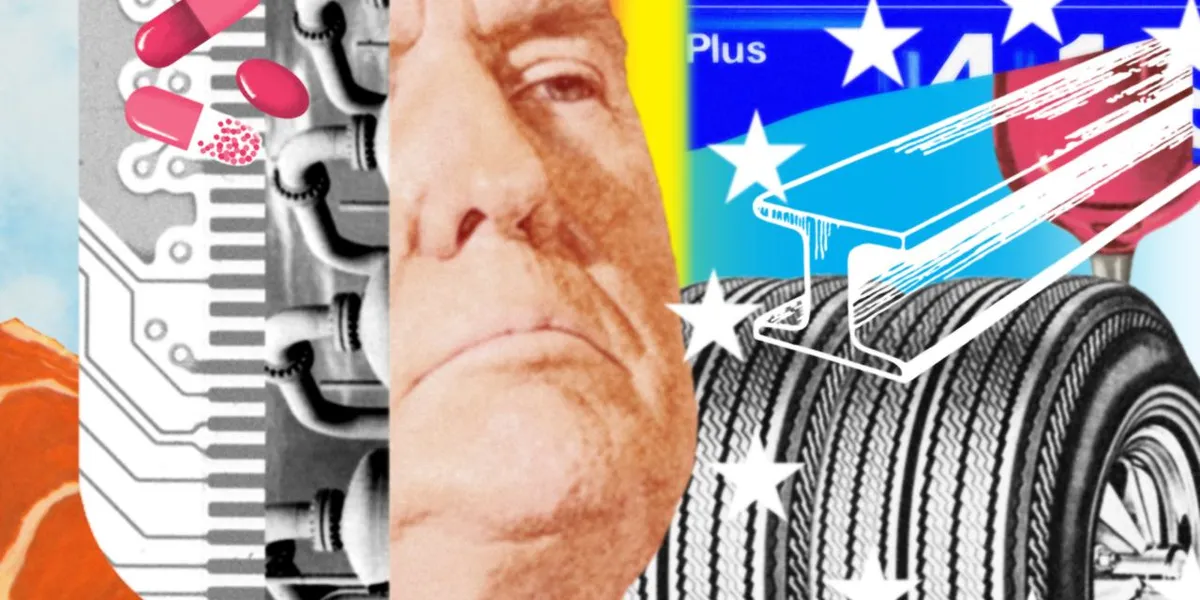

Federal Reserve Chair Jerome Powell is prepared to deliver his first public remarks following the central bank’s first interest-rate cut of 2025. This highly anticipated speech is expected to attract significant attention from investors who are eager to gain insights into the future direction of monetary policy. Powell’s address comes shortly after the newly appointed Fed governor, Stephen Miran, expressed support for substantial rate cuts.

In contrast, two prominent Federal Reserve officials, St. Louis Fed President Alberto Musalem and Atlanta Fed President Raphael Bostic, have recently voiced concerns about further easing of interest rates. Their caution underscores the ongoing debate within the Fed regarding the appropriate response to current economic conditions.

Friday will see the release of the central bank's preferred inflation gauge, known as the PCE inflation metric. Analysts are keenly awaiting this data, as a weak PCE reading could heighten the chances of an additional rate cut in October. The implications of this data could significantly influence investor sentiment and market movements.

In related economic news, the OECD has reported that the U.S. economy is projected to experience a slower decline this year than previously anticipated. However, the organization cautioned that the full effects of ongoing tariffs have yet to materialize, indicating potential challenges ahead for the economy.

Additionally, corporate earnings reports are expected to provide further insights into how tariffs and a slowing labor market are impacting businesses. Notable companies such as AutoZone and Micron Technology are scheduled to release their earnings, which could serve as critical indicators for the market.

As of Tuesday's trading, stock futures exhibited mixed performance in anticipation of Powell’s speech. In a notable market development, gold prices surged to a new record, increasing by 1% to surpass $3,816 per troy ounce, highlighting investor interest in safe-haven assets amidst economic uncertainty.

Stay informed and enhance your understanding of the financial markets by subscribing to our free weekday morning and evening newsletters.