Sydney, June 24 (Reuters) - Global shares experienced a significant rally on Tuesday, while the dollar continued to decline following an announcement by U.S. President Donald Trump that Iran and Israel had reached an agreement on a ceasefire. This news led to a substantial drop in oil prices, alleviating concerns regarding potential supply disruptions in the market. Trump shared this development on his Truth Social platform, suggesting that the ceasefire would take effect within 12 hours, and indicated that the ongoing conflict would be considered resolved thereafter. As of now, there has been no immediate response from Israel regarding this claim.

The situation took a turn when an Iranian official confirmed Tehran's agreement to the ceasefire; however, Iran's foreign minister stated that hostilities would not cease unless Israel halted its attacks. Following this announcement, oil prices saw a decline of over 3%, building upon a 9% drop from the previous day when Iran conducted a token retaliation against a U.S. base. This earlier action appeared to be inconsequential and indicated that Iran was, for the time being, stepping back from further escalation.

With the immediate threat to the crucial Strait of Hormuz shipping lane seemingly mitigated, U.S. crude futures fell another 3.4%, reaching $66.15 per barrel—the lowest price recorded since June 11. As investors now perceive the risk of escalation as diminished, market focus is expected to shift towards the impending tariff deadline set for two weeks from now. Prashant Newnaha, a senior Asia-Pacific rates strategist at TD Securities, noted that a quicker resolution to the Middle East conflict could foster expectations for a swifter conclusion to tariffs and trade agreements.

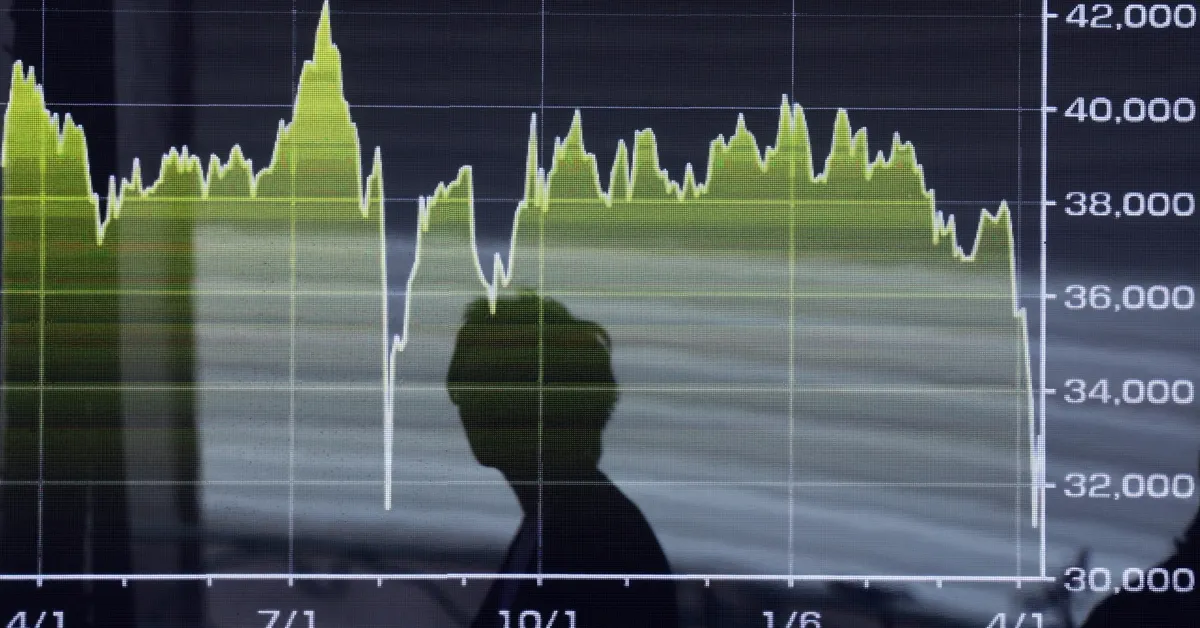

In a robust response to the news of the ceasefire, risk assets responded favorably, with S&P 500 futures rising by 0.6% and Nasdaq futures climbing 0.9%. Similarly, EUROSTOXX 50 futures surged by 1.3%, while FTSE futures increased by 0.4%. Additionally, sources informed Reuters that Japan's tariff negotiator, Ryosei Akazawa, is planning his seventh visit to the United States as early as June 26, aiming to negotiate the removal of tariffs detrimental to Japan's economy.

The announcement of the ceasefire contributed to an ongoing decline of the dollar, which slipped 0.3% to 145.70 yen after previously peaking at a six-week high of 148 yen. Meanwhile, the euro appreciated by 0.2%, reaching $1.1594 on Tuesday, following a 0.5% increase overnight. Both the yen and euro benefited from the decrease in oil prices, as both the European Union and Japan heavily rely on imports of oil and liquefied natural gas, unlike the United States, which is a net exporter.

Chris Weston, head of Research at Pepperstone, commented on the market's preparedness against significant risk events, stating, “The market was so well hedged against a major tail-risk event to play out…the actions and the dialogue we’ve seen highlight that the tail risks have not and will highly unlikely materialise.”

In the bond market, ten-year Treasury yields rose by 2 basis points to 4.35%, recovering from a 5-basis point decline overnight. This shift occurred after Federal Reserve Vice Chair for Supervision, Michelle Bowman, indicated that the time to consider interest rate cuts may be approaching, given the increasing risks to the job market. Fed Chair Jerome Powell is expected to provide his insights when he appears before Congress later on Tuesday, though he has maintained a cautious stance regarding immediate easing measures. Currently, the markets imply only a 22% chance that the Fed will implement a rate cut during its next meeting on July 30.

Amidst the risk-on sentiment, gold prices saw a decrease of 0.6%, settling at $3,346 an ounce.

Reporting by Wayne Cole and Stella Qiu; Ankur Banerjee in Singapore; Editing by Sam Holmes.