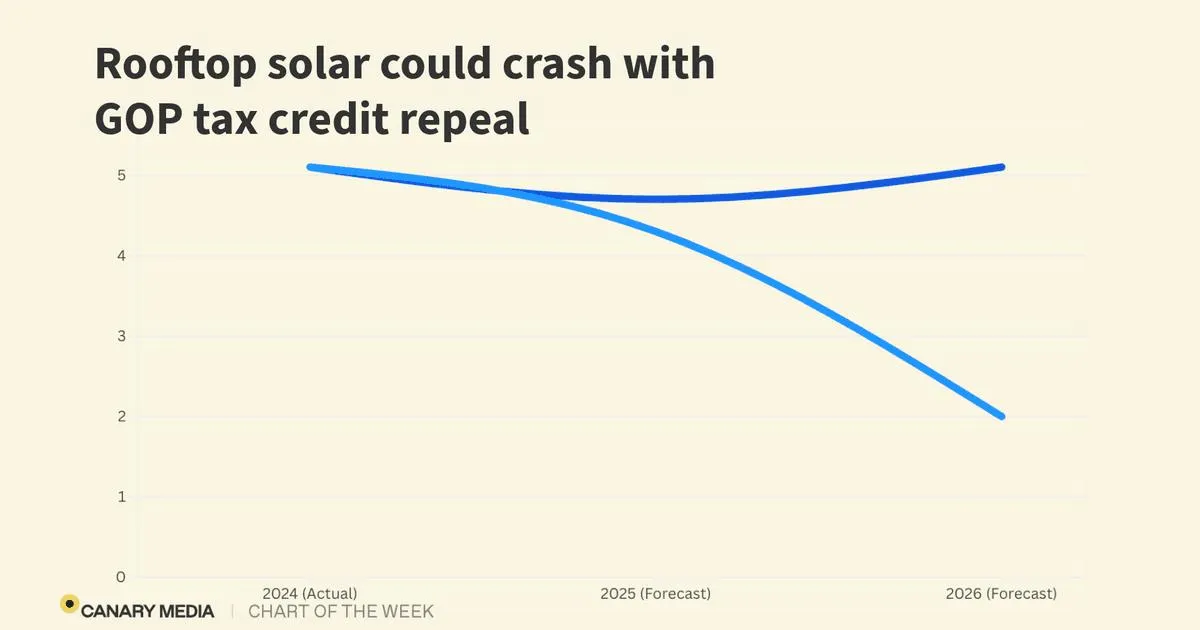

Rooftop solar energy is facing significant challenges in the United States, and recent legislative actions could exacerbate these issues. The budget bill recently passed by House Republicans threatens to send the residential solar sector into a severe decline. According to a forecast from market research firm Ohm Analytics, if this bill progresses in its current form, only 2 gigawatts of residential solar would be installed by 2026. This figure represents a staggering 60% decrease from the 5.1 gigawatts installed in the previous year.

The primary cause of this anticipated downturn is the proposed elimination of federal tax credits for residential solar. These incentives have been crucial for homeowners, making solar installations approximately 30% more affordable. Renewed for another decade under the 2022 Inflation Reduction Act, these tax credits are now under threat. If the GOP budget bill is ratified, homeowners could lose access to these critical savings within just six months, presenting a significant hurdle for those seeking to reduce their energy expenses via rooftop solar.

As utility bills continue to rise across the nation, many households are looking towards rooftop solar as a solution to lower their energy costs. Generally, households that install solar panels see a decrease in their electricity expenses, with lower-income families benefiting the most. However, without the federal tax credits, the financial burden of installing solar becomes much heavier, pushing this renewable energy option out of reach for many, particularly those who would gain the most from it.

According to estimates from Ohm Analytics, the average homeowner would face an extended payback period of five to six years longer to recoup their solar investment if these incentives were to disappear. This change could deter many potential buyers from making the switch to solar, further stalling the growth of the residential solar market.

The proposed tax-credit repeal would mark a significant setback for the already struggling residential solar industry in the U.S. The sector reached a peak in 2023, with 6.8 gigawatts of panels installed nationwide. However, California, the leading residential solar market, has already taken steps to diminish the financial viability of solar by reducing the compensation households receive for selling excess solar energy back to the grid. Coupled with high-interest rates that have made financing solar installations more challenging, these factors have led to recent bankruptcies among major national rooftop solar firms.

As the Senate Finance Committee continues to deliberate on its version of the tax bill, which aligns with the House budget bill in proposing the elimination of tax credits for rooftop solar, uncertainty looms large. The potential repeal or reduction of these credits would not only be a significant setback for energy affordability but would also jeopardize the livelihood of approximately 100,000 individuals employed in the U.S. residential solar industry. More critically, it would impede efforts to reduce carbon emissions from the power sector, stalling progress towards a more sustainable energy future.