The semiconductor giant Nvidia has long depended on ARM Holdings for the CPU cores embedded in its superchips. The company even attempted to acquire chip designer ARM, but the Federal Trade Commission (FTC) intervened and blocked the acquisition. Currently, Nvidia (NVDA) stands as the world's most valuable company, and it has ambitious plans for new chips based on ARM designs. One of the upcoming innovations includes a laptop chip named N1, derived from the GB10 superchip.

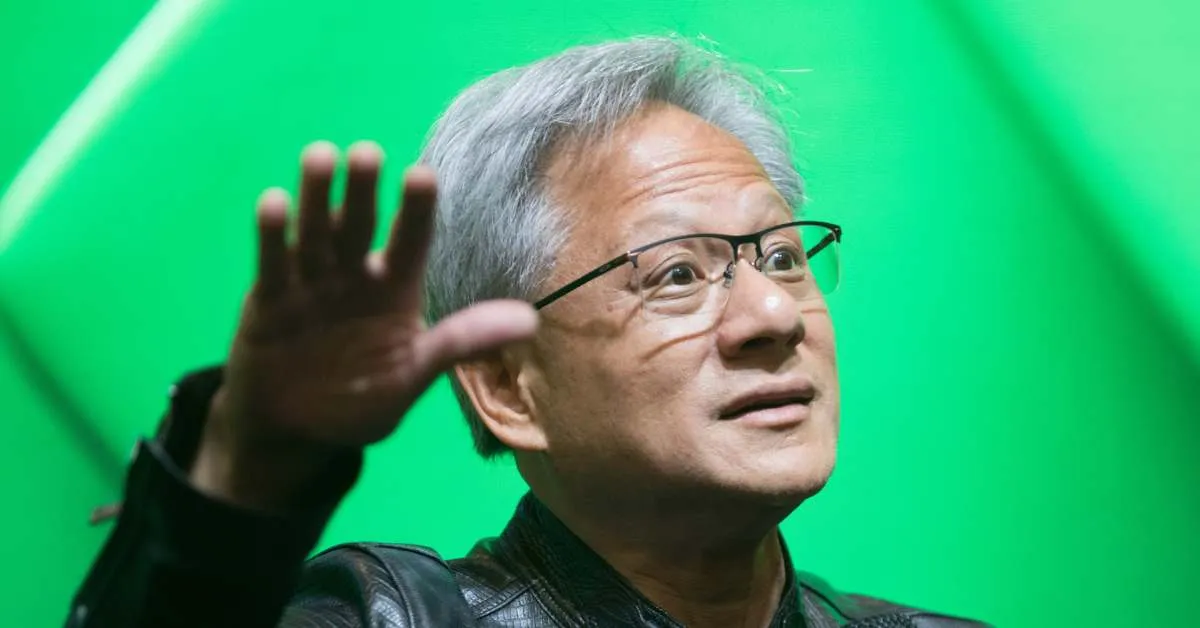

On August 27, Nvidia released its financial results for the second quarter of fiscal 2026, showcasing impressive growth. The company's net income soared by 59% year-over-year to reach $26.4 billion. Nvidia's founder and CEO, Jensen Huang, highlighted the significance of Nvidia NVLink rack-scale computing, describing it as revolutionary at a time when reasoning AI models are driving unprecedented increases in both training and inference performance.

Nvidia's Q2 earnings report revealed:

Revenue growth of 56% to $46.7 billion year-over-year Gross margin at 72.4%, down from 75.1% in Q2 FY 2025 Net income of $26.4 billion, reflecting a 59% increase year-over-yearLooking ahead, Nvidia's outlook for the third quarter of fiscal 2026 projects revenue of approximately $54.0 billion, with a gross margin expectation of 73.3%. Notably, the company has not factored in any H20 shipments to China in its forecasts.

On September 18, Nvidia announced a significant partnership with Intel (INTC), revealing plans to develop multiple generations of custom data center and PC products. Nvidia will invest $5 billion in Intel's common stock. This partnership will enable Nvidia to incorporate custom Intel x86 server CPUs into its scalable rack architecture using NVLink, a capability previously limited to Nvidia's custom ARM CPUs.

Intel will also engineer x86 system-on-chips that integrate Nvidia RTX GPU chiplets specifically for the PC market. Intel CEO Lip-Bu Tan commented on the collaboration, stating that Intel's advanced data center and client computing platforms would synergize with Nvidia's AI and accelerated computing leadership, paving the way for groundbreaking advancements in the industry.

The announcement generated positive market reactions for Intel, with shares surging by 22.8% for the week, closing at $29.58, marking a year-to-date increase of 47.5%. Following the Nvidia-Intel partnership, analysts at Bank of America, led by Vivek Arya, revised their outlook on Nvidia shares. They noted that while the product development timeline remains uncertain and could extend over several years, this partnership could positively influence Nvidia's access to enterprise AI deployments.

Despite the enthusiasm surrounding the partnership, analysts pointed out several risks for Nvidia. These include:

Weakness in the consumer-driven gaming market Intensified competition with major public firms Larger-than-expected impacts from restrictions on compute shipments to China Volatile sales in new enterprise, data center, and automotive markets Potential for decelerating capital returns Increased government scrutiny of Nvidia's dominant position in the AI chip marketDespite these challenges, Arya maintained a buy rating for Nvidia, establishing a target price of $235 based on a price-to-earnings ratio of 37, excluding cash for the calendar year 2026. This multiple is considered reasonable, given Nvidia's dominant share in the rapidly growing AI compute and networking markets, even when accounting for variability in global AI projects and cyclical trends in the gaming market.

As of Friday, Nvidia shares experienced a slight increase to $166.60, reflecting a modest decline of 0.7% for the week, but an impressive gain of 31.5% year-to-date.