Nvidia, the leading semiconductor company driving the artificial intelligence revolution, announced on Thursday its decision to acquire a significant $5 billion stake in its struggling competitor, Intel. This strategic investment marks a pivotal moment for both companies, as they will also embark on a collaborative partnership aimed at developing cutting-edge chips for personal computers and data centers.

The news of Nvidia’s investment sent shockwaves through the stock market, causing Intel shares to surge by an impressive 23%. This surge boosted Intel's market capitalization to approximately $143 billion, marking a remarkable 52% increase in its stock value this year. Meanwhile, Nvidia, which boasts a valuation exceeding $4.2 trillion, saw its shares rise by 3.5% in response to the announcement.

This announcement comes on the heels of significant investments in Intel, including a recent purchase of a 10% stake by the U.S. government, valued at nearly $9 billion, and a $2 billion investment from Japan's SoftBank. Tech analyst Dan Ives hailed the deal as a transformative moment for Intel, stating, “This is a game changer deal for Intel as it now brings them front and center into the AI game.”

Ives further noted that this partnership positions Intel as a crucial player in the ongoing AI arms race against China. “Today’s announcement further strengthens the U.S. lead in the AI Arms Race against China as Intel now goes from a laggard to a catalyst,” he concluded, emphasizing the strategic importance of this collaboration.

Historically, Intel was synonymous with innovation in the semiconductor industry, powering computers, servers, and other electronic devices. However, the company has faced considerable challenges in recent years, including a series of CEO changes, technical missteps, and strategic pivots that have caused it to fall behind rivals such as Nvidia, AMD, and Broadcom in the mobile and AI sectors. As a result, Intel's sales and profit margins have taken a significant hit.

The White House has recognized AI and chip manufacturing as critical components of national security. In a recent turn of events, Intel's CEO Lip-Bu Tan, who took the helm in March, faced pressure from former President Donald Trump to resign amid concerns regarding his past affiliations with Chinese firms. Following a meeting between Tan and Trump in the Oval Office, the tone shifted positively, leading to the announcement of the unprecedented investment made possible through the Biden-era CHIPS Act.

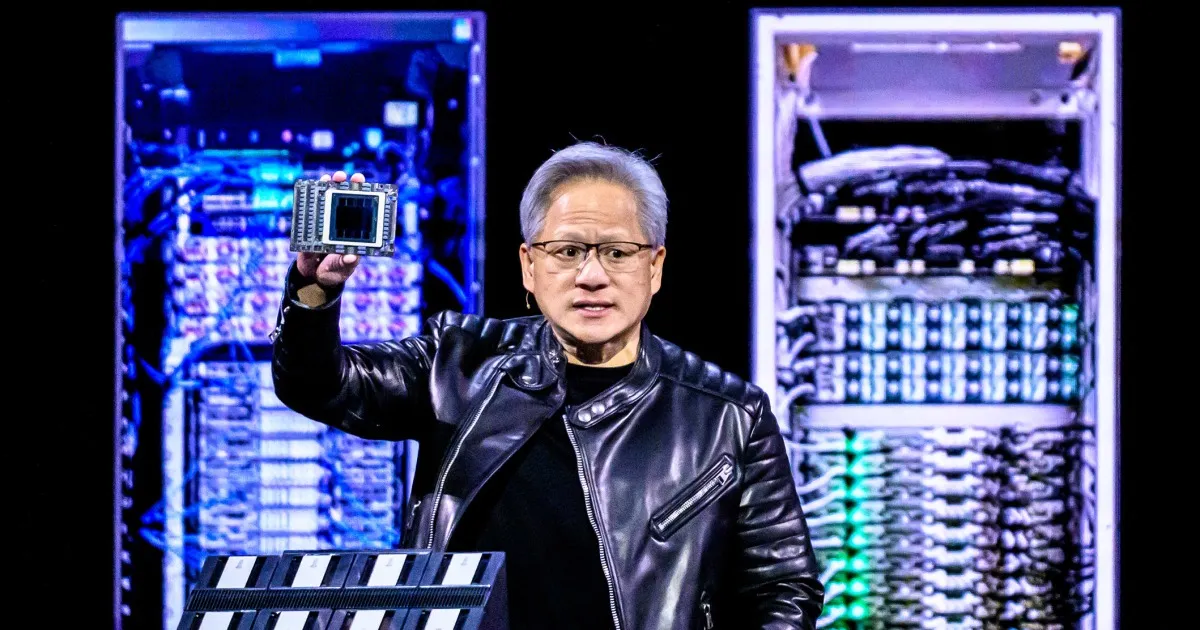

Meanwhile, Nvidia’s CEO Jensen Huang has emerged as a prominent figure in political circles, having been a regular attendee at events during the Trump administration. Just recently, Huang participated in a state dinner at Windsor Castle alongside Trump and King Charles III, where Trump praised Huang's contributions to the tech industry, stating, “You're taking over the world, Jensen.” Additionally, Nvidia announced a substantial investment of over $14 billion into AI and data center infrastructure in the U.K., further solidifying its role as a leader in the semiconductor space.