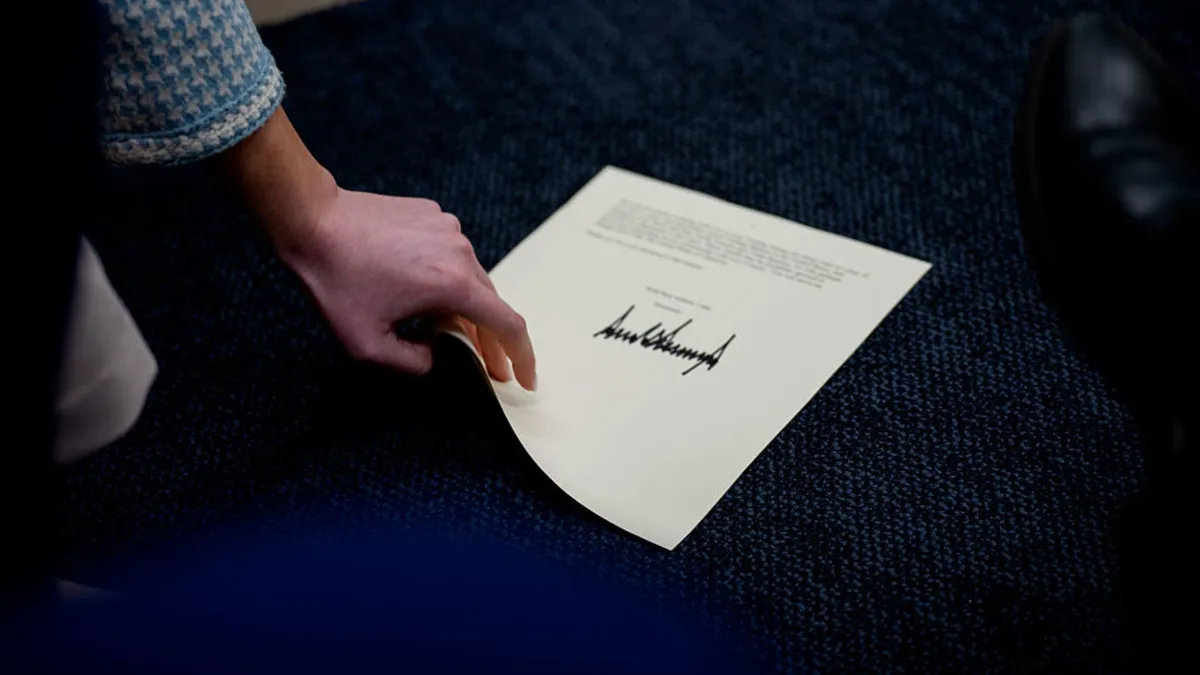

In a significant move, U.S. President Donald Trump has sent the first batch of tariff letters to key trading partners, specifically targeting two of America's closest allies in Asia: Japan and South Korea. Both nations are currently facing challenges due to existing duties on their auto and steel exports, and the introduction of additional tariffs threatens to exacerbate their economic difficulties. As these exports-dependent economies grapple with a slowdown in growth, Japan is on the verge of a technical recession, defined by two consecutive quarters of economic contraction.

Recent reports indicate that both Japan and South Korea experienced a contraction in their gross domestic product (GDP) during the first quarter of the year. As South Korean imports to the U.S. are already subject to a 25% tariff—as promised by Trump in April—the new tariff rate for Japan has been increased by 1 percentage point to the same 25%. According to the latest data from the World Bank, exports, including services, constituted nearly 22% of Japan's GDP in 2023, while South Korea's exports made up a staggering 44% of its GDP.

Currently, imports of automobiles and auto parts to the U.S. incur a hefty 25% tariff. Additionally, steel and aluminum face a 50% levy from most countries. Automobiles represent Japan's largest export to the U.S. and are also among South Korea's top exports. Notably, South Korea ranked as the fourth-largest exporter of steel to the U.S. in 2024, according to the International Trade Administration under the U.S. Commerce Department.

Japan's Prime Minister Shigeru Ishiba has expressed the country's desire to reach an agreement that benefits both nations while safeguarding Japan's national interests. In a statement made in May, Ishiba emphasized that Japan would not agree to a deal that does not involve the removal of auto tariffs. The newly introduced tariffs are expected to lower Japan's GDP by 0.1 percentage points by the end of 2026, as estimated by Norihiro Yamaguchi, Lead Japan Economist at Oxford Economics. Yamaguchi noted that Japan's economy is already weakened by high tariffs on autos, elevated global trade policy uncertainty, and sluggish consumption.

The U.S. remains Japan's largest export market, with shipments valued at 21.3 trillion yen (approximately $145.76 billion) in 2024. Conversely, South Korea exported goods worth $127.8 billion to the U.S. during the same year, making the U.S. its second-largest export market. In light of the intensified tariff policies, the Bank of Korea recently slashed its GDP growth estimates for 2025 from 1.5% to 0.8%. The delay in domestic demand recovery and anticipated slowing export growth due to U.S. tariffs is a cause for concern, according to the Bank of Korea.

Frederic Neumann, Chief Asia Economist at HSBC, warned that if Japan and South Korea fail to negotiate a deal, these tariffs could significantly hinder their economic growth. Both nations are already dealing with sluggish domestic demand. On a more optimistic note, Trump indicated a willingness to adjust the tariff letters if Japan and South Korea were to open their previously closed markets to U.S. products.

According to Vishnu Varathan, managing director at Mizuho Securities, there is pressure being exerted on both countries. He noted that the frustration with Japan's principled approach to sectoral tariffs has stalled negotiations, which has become a source of irritation for U.S. trade negotiators. Although Trump has not publicly criticized South Korea, Varathan suggested that there may be similar sticking points hindering progress with them as well.

Interestingly, financial markets appear to be downplaying the impact of the latest tariff threats—for the time being. Neumann commented that Trump's letters essentially provide a three-week extension for tariff negotiations. Market analysts are focusing on the potential for these threatened tariffs to be reduced through ongoing negotiations, which offers a glimmer of hope amid the uncertainty.