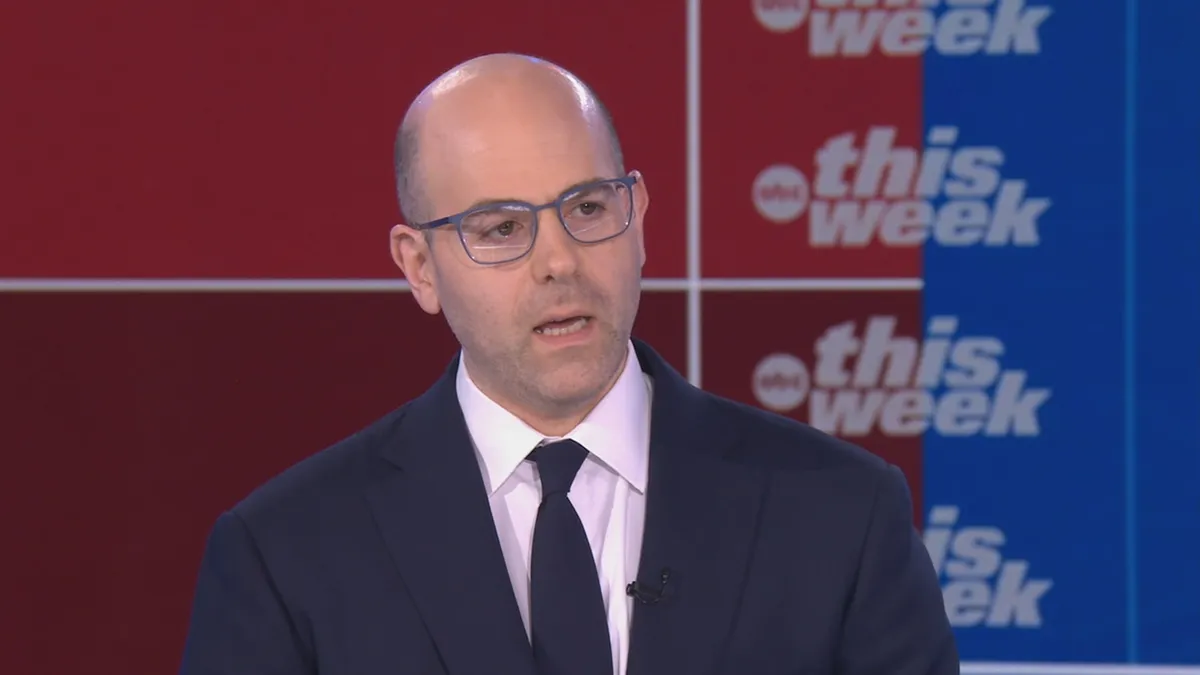

In a recent interview, Stephen Miran, the Chair of the White House Council of Economic Advisers, addressed the ongoing negotiations between the United States and several countries regarding trade tariffs. As the deadline set by President Donald Trump approaches, Miran indicated that those nations negotiating in good faith may experience a delay in tariff implementation.

During his conversation with ABC News' This Week anchor George Stephanopoulos, Miran expressed optimism about the potential for new trade agreements. He noted, "The president's deadline is approaching for the deals. You've only seen three deals so far. What should we expect next?” To this, Miran replied, “I’m still optimistic that we’re going to get a number of deals later this week. Part of that is because all the negotiating goes through a series of steps that lead to a culmination timed with the deadline.”

When pressed about the possibility of extending the deadline for countries that are struggling to finalize deals, Miran suggested that it could happen. He stated, “Well, my expectation would be that countries that are negotiating in good faith and making the concessions that they need to get to a deal, but the deal is just not there yet because it needs more time, my expectation will be that those countries get a roll, you know, sort of get the date rolled.”

Although he refrained from naming specific countries, Miran mentioned that discussions with Europe and India have been promising, indicating that nations making necessary concessions might benefit from a deadline extension. Conversely, he warned that countries that fail to negotiate in good faith may face higher tariffs.

Joining the discussion was former Treasury Secretary Larry Summers, who expressed skepticism about the economic benefits associated with Trump’s tariffs. He remarked, “It probably will collect some revenue at the cost of higher inflation for American consumers, less competitiveness for American producers.” Summers highlighted that the potential outcome could lead to higher prices, reduced competitiveness, and minimal revenue relative to the significant tax benefits provided to wealthy individuals in the recent budget proposal.

In response to a question about the CBO estimates regarding healthcare coverage losses due to Medicaid cuts, Miran defended the reliability of the CBO’s predictions. He stated, “Well, because they’ve been wrong in the past.” Miran referenced previous predictions made by the CBO, arguing that the actual loss of insurance was far lower than anticipated. He emphasized that economic growth and job creation are the best ways to ensure people have insurance.

Stephanopoulos raised concerns about whether current tax cuts would lead to sustainable growth, referencing the past tax cuts during President Ronald Reagan's administration. Miran contested this notion, citing growth during Trump’s first term and asserting that there was no significant decline in revenue as a result of tax cuts. He claimed that corporate revenue and overall economic growth surged as a result of the Tax Cuts and Jobs Act.

Summers articulated significant concerns regarding cuts to the American safety net, labeling the current bill as potentially hazardous to the economy. He cited estimates suggesting that the bill could lead to thousands of deaths over a decade due to reduced healthcare access. “These higher interest rates, these cutbacks in subsidies to electricity, these reductions in the availability of housing... that’s going to mean more inflation, more risk that the Fed has to raise interest rates and run the risk of recession,” he explained. Summers concluded that prioritizing tax cuts for the wealthiest Americans over the welfare of middle-class families is misguided.

In closing, Stephanopoulos queried Miran about claims that economic growth stemming from the proposed bill could offset the risks identified by Summers. Miran maintained that the Council of Economic Advisers projected significant deficit reduction due to growth, increased tax revenue, and savings on debt payments, reiterating the administration's confidence in the economic strategy.