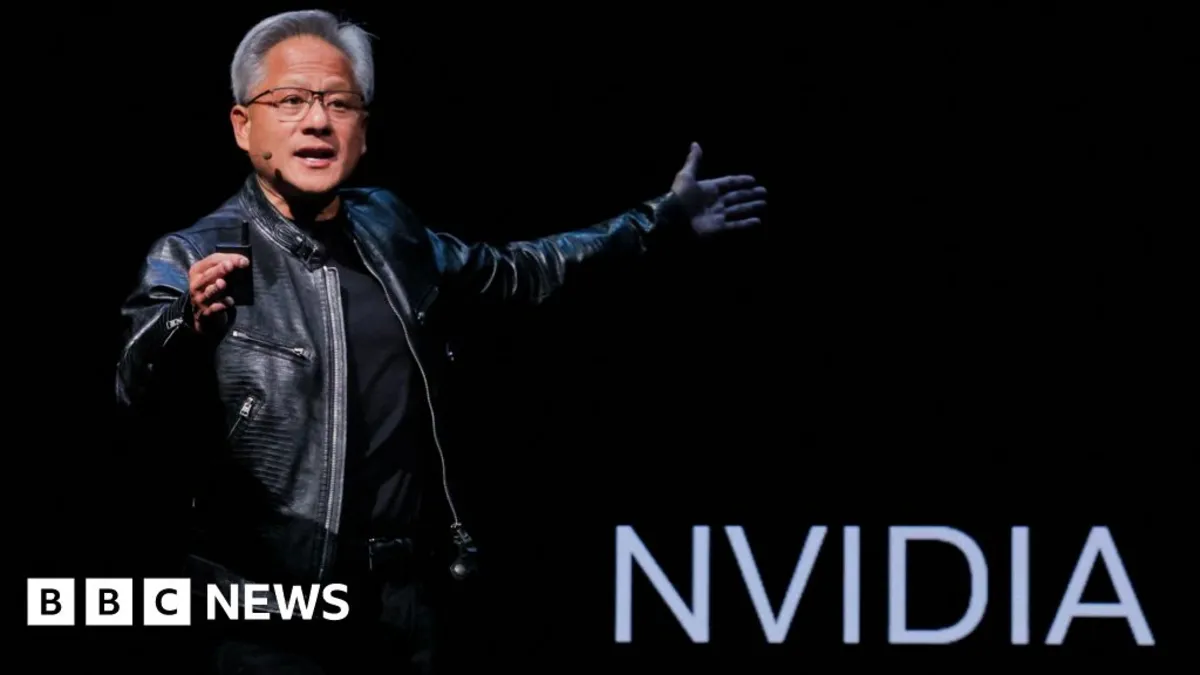

Nvidia has reached a remarkable milestone, becoming the world's first company to achieve a market value of $5 trillion (£3.8 trillion). This achievement highlights the company's transformation from a niche graphics-chip manufacturer to a dominant player in the artificial intelligence (AI) sector. The ongoing excitement surrounding the potential of AI continues to drive demand for Nvidia's chips, pushing its stock to unprecedented heights.

The US chip-maker first hit a market value of $1 trillion in June 2023, and just three months ago, it reached the $4 trillion valuation mark. Recently, Nvidia's shares surged by as much as 5.6%, climbing to over $212 on Wednesday morning. This uptick was fueled by investor optimism regarding Nvidia's sales in China, a region that has become a geopolitical flashpoint.

As the world's most valuable company, Nvidia has emerged as a significant beneficiary of the current AI spending spree. The firm has outpaced its rivals in the technology sector by forming partnerships with leading AI companies, including OpenAI and Oracle. These collaborations have allowed Nvidia's chips to power the ongoing AI boom, further solidifying its position in the market.

According to data from the World Bank, Nvidia's value now surpasses the GDP of every country except the United States and China, and it exceeds entire sectors of the S&P 500. Other technology giants, such as Microsoft and Apple, have also recently crossed the $4 trillion valuation threshold, contributing to a broader tech rally driven by optimism on Wall Street regarding AI spending.

Despite the impressive gains, concerns about a potential AI bubble are growing. Critics question whether technology companies are overvalued, especially as tech stocks continue to reach record highs. Prominent warnings have come from the Bank of England, the International Monetary Fund, and Jamie Dimon, the CEO of JP Morgan, who emphasized that the level of uncertainty should be greater in most investors' minds.

Danni Hewson, head of financial analysis at AJ Bell, remarked that Nvidia's $5 trillion valuation is so vast that it is difficult for most people to comprehend. She noted that while this valuation may intensify fears surrounding an AI bubble, the market appears determined to continue its upward trajectory.

Some skeptics are now questioning whether the rapid rise in values of AI tech companies may, in part, be attributed to what they refer to as financial engineering. Major AI firms have been investing in one another, creating a complex web of deals that is attracting scrutiny. For instance, OpenAI, which popularized AI in the consumer market with ChatGPT in 2022, secured a staggering $100 billion investment from Nvidia last month.

As Nvidia continues to thrive and reshape the technology landscape, the interplay between its remarkable valuation and the broader market dynamics will be closely watched by investors and analysts alike.