Warren Buffett, the iconic investment mogul, has largely refrained from commenting on recent market fluctuations and tariff policies. However, the 94-year-old legend will finally share his insights during the highly anticipated Berkshire Hathaway annual shareholder meeting this Saturday. Tens of thousands of enthusiastic shareholders are expected to gather in Omaha, Nebraska, for this event, often referred to as the "Woodstock for Capitalists." This year's meeting is particularly significant as it marks the 60th anniversary of Buffett's leadership at Berkshire Hathaway, and it is the second meeting since the passing of his long-time business partner, Charlie Munger, who died in late 2023.

This year's shareholder meeting comes at a time of heightened economic uncertainty, exacerbated by President Donald Trump's implementation of the highest tariffs on imports seen in generations. Although many of these tariffs were suspended temporarily, the impact on the market has been profound. Wall Street economists are increasingly sounding alarms, suggesting that a recession may be imminent as new data reveals troubling signs of economic weakening. With Berkshire Hathaway owning a diverse range of businesses, the conglomerate is considered a bellwether for economic trends. Steve Check, founder of Check Capital Management and a major Berkshire shareholder, expressed concerns over whether the economic situation is even more dire than current data suggests.

As the Oracle of Omaha, Warren Buffett's opinions carry significant weight in the investment community. Many investors are looking forward to his perspective on the ongoing market turmoil, particularly regarding the implementation of tariffs. "I hope, more than anything, that he speaks out against the way tariffs have been handled," Check remarked, underscoring the anticipation surrounding Buffett's comments.

In a demonstration of caution, Berkshire Hathaway has sold more stock than it has purchased for the past nine quarters, totaling over $134 billion in 2024 alone. This selling trend primarily stemmed from significant reductions in Berkshire's two largest equity holdings: Apple and Bank of America. Consequently, Berkshire's cash reserves have soared to a record high of $334.2 billion by December 2024. Investors are keen to discover whether Buffett leveraged the April market downturn to scout for potential bargains and set the stage for future acquisitions. Although he typically avoids making short-term market predictions, investors will closely analyze his remarks for indications of his enduring confidence in the U.S. economy, despite the tariff challenges.

Many shareholders are keen to know how Buffett plans to utilize the substantial cash reserves Berkshire has accumulated. "The big question on everyone's mind is what Buffett will do with the cash pile and when it can be deployed," noted David Wagner, a portfolio manager at Aptus Capital Advisors and a Berkshire shareholder. Investors often regard Buffett as a guiding light in uncertain times, and his actions could signal a clearer path forward for the market.

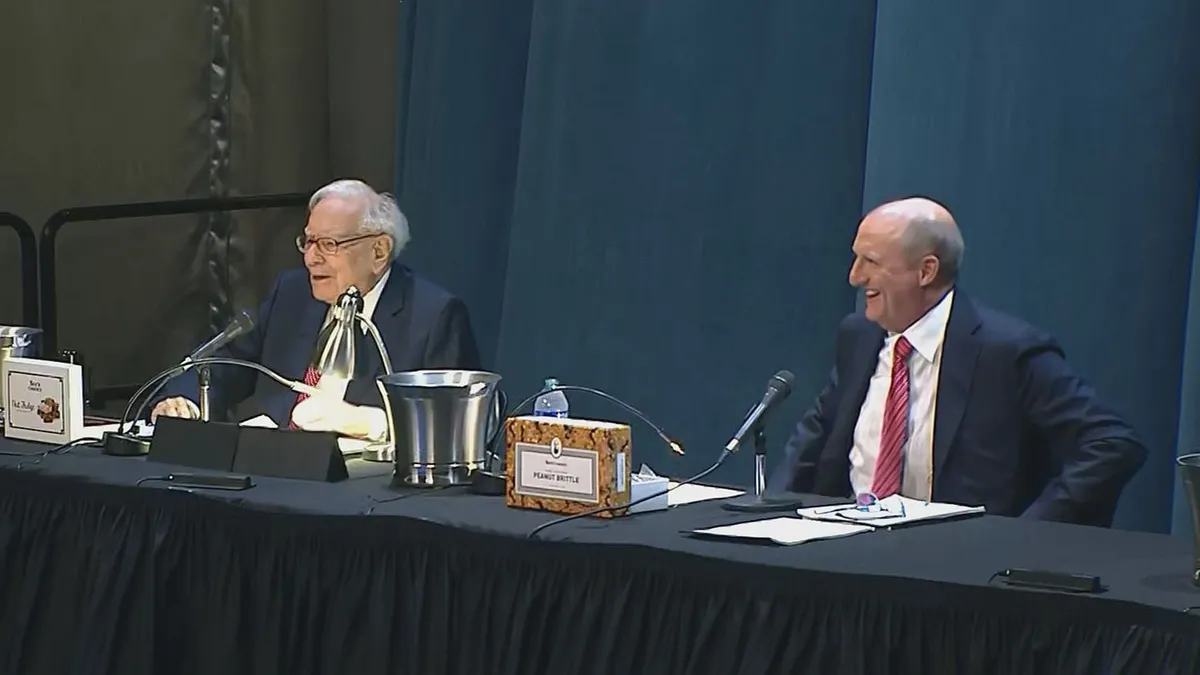

The meeting will kick off at 9 AM ET on Saturday, featuring Buffett's introductory remarks followed by an extensive Q&A session. Joining him on stage will be his designated successor, Greg Abel, and Berkshire's insurance chief, Ajit Jain. The Q&A session will be broadcast live on CNBC and available for streaming in both English and Mandarin, making it accessible to a global audience.

Shareholders are particularly interested in Buffett's decision to cut back on his long-standing stake in Apple. After an unprecedented selling spree over four consecutive quarters, Berkshire's Apple holdings have stabilized at 300 million shares since the end of September. Many speculate that Buffett has paused his selling efforts for now. During last year's meeting, he hinted that the sales were motivated by tax considerations following substantial gains. However, with a shift in the political landscape in Washington, shareholders are eager for clarity on his reasoning. Finance professor David Kass from the University of Maryland pointed out that the previous tax-related rationale may no longer apply. If Buffett were to sell more shares, it could suggest he believes the stock is fully valued or that he is wary of potential risks, such as a trade war and tariffs affecting Apple’s future.

As Berkshire Hathaway prepares to release its first-quarter earnings report on Saturday morning, investors will be looking for insights into the conglomerate's top equity holdings, which could offer further clarity on the status of the Apple stake and Buffett's investment strategies moving forward.