As President Trump approaches the milestone of his 100th day in office this week, the state of the U.S. economy presents a sobering picture. Economic growth appears to be decelerating, the stock market has experienced significant declines, and consumer confidence has plummeted to its lowest levels since the COVID-19 pandemic began. This scenario starkly contrasts with the optimistic outlook Trump projected on his Inauguration Day just over three months prior.

New data from the Commerce Department, set to be released on Wednesday, is expected to reveal that the United States' gross domestic product (GDP) grew at a much slower pace in the first quarter of the year compared to the final months of 2024. This upcoming quarterly GDP report will encompass the closing weeks of the Biden administration alongside the initial months of Trump's term, during which the early signs of the president's trade war began to surface. A notable factor contributing to this slowdown is a dramatic increase in imports, as businesses and consumers rushed to stockpile goods before the implementation of Trump's extensive tariffs in early April. It is important to note that imports negatively impact GDP.

Forecasts suggest that personal spending also decelerated during the first quarter, following robust growth at the end of the previous year. According to Mark Zandi, chief economist at Moody's Analytics, “Consumers continued driving the train but with much less gusto than they have been up until now.” The Conference Board's consumer confidence index has declined for five consecutive months, with tariffs now surpassing inflation as the primary concern for many. A significant portion of those surveyed express anxiety that Trump's import taxes will elevate prices and potentially lead the economy towards a recession. Alarmingly, the forward-looking components of the confidence index are already significantly below the threshold that usually indicates an impending recession.

While the job market has remained relatively stable, with an unemployment rate of just 4.2% in March, the confidence survey by the Conference Board revealed that expectations regarding the job market are the bleakest since 2009, a time when the economy was losing hundreds of thousands of jobs monthly. Additionally, the decline of the stock market has further eroded consumer confidence. As of Tuesday, the S&P 500 index had fallen by 7.3% since Inauguration Day, while the tech-heavy Nasdaq was down 11%. This marks the worst market performance at the onset of a new presidency since the 1970s.

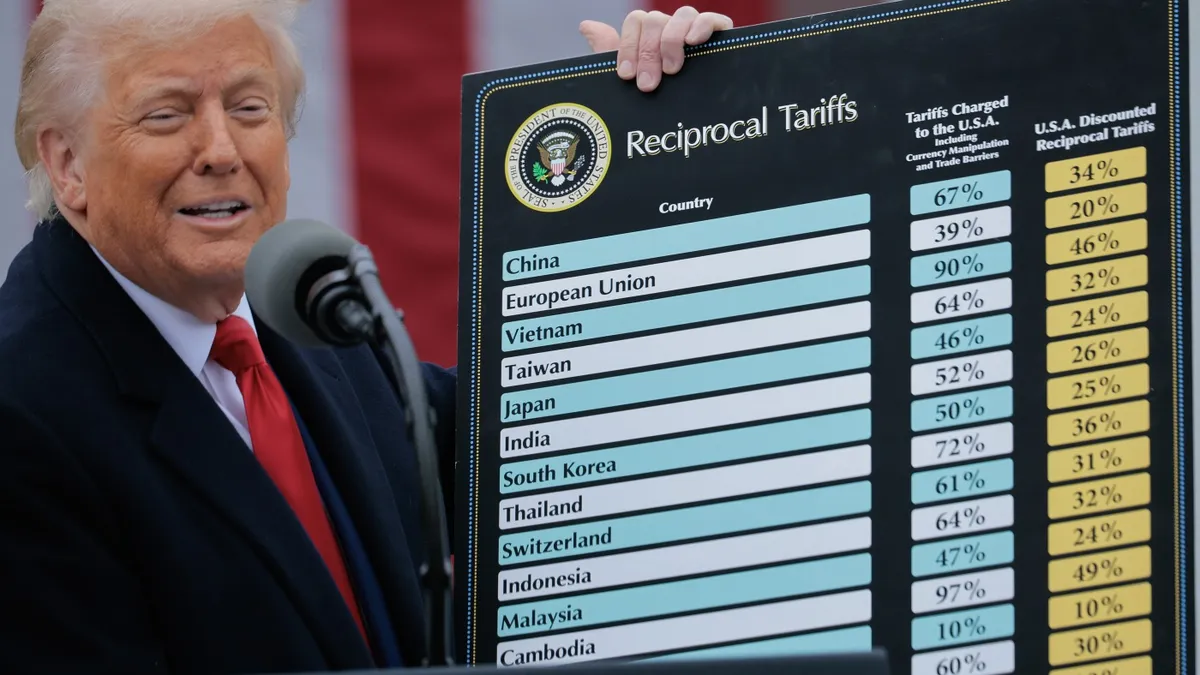

Businesses are grappling with the uncertainty that Trump's policies have created. The president has imposed a 10% tax on nearly all imports to the United States, coupled with exorbitant tariffs of 145% on several products from China. Furthermore, Trump has proposed additional tariffs, only to later suspend them, leaving businesses and consumers in a state of uncertainty regarding future import tax scenarios. Curt Carpenter, who operates a furniture and lighting store in Boston, imports most of his lighting fixtures from China. He stated that the tariffs have adversely affected his business even more than the 2008 housing crisis. “At the end of the day, it's just a tax on the end consumers,” Carpenter noted, adding, “We’re definitely losing business. But we’re not losing it to a competitor; we’re just losing the opportunity for a sale.”

Interestingly, some sectors are voicing support for the tariffs. Tom Barr, a third-generation mold maker in Michigan, produces plastic injection molding equipment primarily for the auto industry. After facing stiff competition from China, he has noticed a surge in inquiries from potential customers since the implementation of Trump’s high tariffs. “Somebody reached out to us from Ford Motor Company,” Barr recounted. “They’re investigating it. They’re not saying they’re going to do anything, but they want to know what their options are.” Barr believes that while tariffs have their place, they should be more strategically targeted to assist domestic producers without adversely affecting the broader economy.