Former President Donald Trump has attempted to shape the U.S. economy according to his vision, yet one formidable force remains unaffected: the financial markets. Trump has boldly claimed that the outcomes of his tariffs will eventually lead to a “beautiful” economic landscape. However, the reality of the situation has been starkly different over the past three months, characterized by a significant decline in consumer confidence, turbulent stock markets, and a waning trust in the efficacy of Trump's economic strategies.

Instead of ushering in the promised golden age of prosperity, the current climate has bred anxiety among consumers and investors alike. Trump's unilateral approach to reshape the economy, often circumventing the Republican-controlled Congress, has resulted in the imposition of hundreds of billions of dollars in tariffs. This includes hefty penalties on America's two largest trading partners, Mexico and Canada, as well as a staggering 145% tax on Chinese goods.

These trade penalties have escalated tensions with the European Union and prompted countries like Japan and South Korea to rush into negotiations to mitigate the impact. Despite the evidence showcasing American economic strength, Trump has insisted that the U.S. has been "ripped off" in trade deals.

Trump contends that his tariffs will not only generate domestic factory jobs but also finance a proposed income tax cut plan that could exceed $5 trillion over a decade. He argues that these measures could help repay the staggering $36 trillion national debt and serve as leverage for renegotiating trade agreements that favor the United States. Nonetheless, a report from The Budget Lab at Yale University suggests that these tariffs could ultimately decrease the disposable income of the average household by as much as $4,900.

In a bid to bolster economic growth, Trump has leveraged his position to promote various investment announcements. Notable among these is a projected $500 billion investment in artificial intelligence from companies such as OpenAI, Oracle, and SoftBank. Additionally, he hosted Hyundai executives at the White House to celebrate the announcement of a new steel mill in Louisiana. However, despite these high-profile announcements, factory construction saw a decline in February, and external analysts have raised the likelihood of an impending recession this year.

Moreover, Trump has directed significant support toward the coal and oil sectors while criticizing alternative energy sources. Ironically, his tariffs have resulted in increased prices for steel and other critical materials required by the energy industry to expand production capabilities.

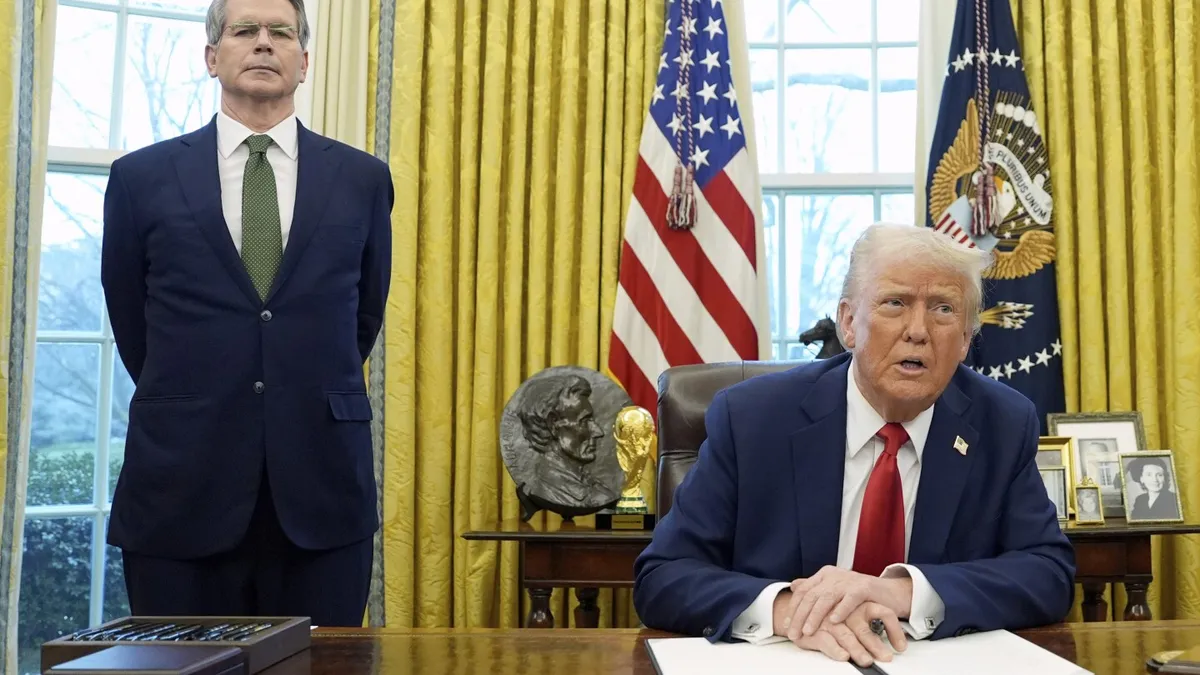

Commerce Secretary Howard Lutnick has stated that Trump will assume full ownership of the economy in the final quarter of the year, anticipating that the administration's policies will be completely in place by then. As the economic landscape evolves, it remains to be seen whether Trump's ambitious plans will yield the desired results or exacerbate existing challenges.