This week’s economic and business calendar is packed with significant events that investors should keep an eye on. The reciprocal tariffs deadline, the release of Federal Reserve meeting minutes, and the highly anticipated Amazon Prime Day are set to dominate the headlines. Additionally, data concerning consumer credit levels and jobless claims will be closely monitored by market participants. Major companies like Delta Air Lines and Conagra Brands are also scheduled to report their quarterly earnings, adding to the week’s excitement.

As investors prepare for these developments, it’s important to note that the stock markets concluded last week on a high note. The S&P 500 and Nasdaq both achieved record highs on Thursday, while the Dow Jones Industrial Average remained near its previous peak. In a notable political move, President Donald Trump signed a significant taxation-and-spending bill into law, which could impact economic conditions moving forward.

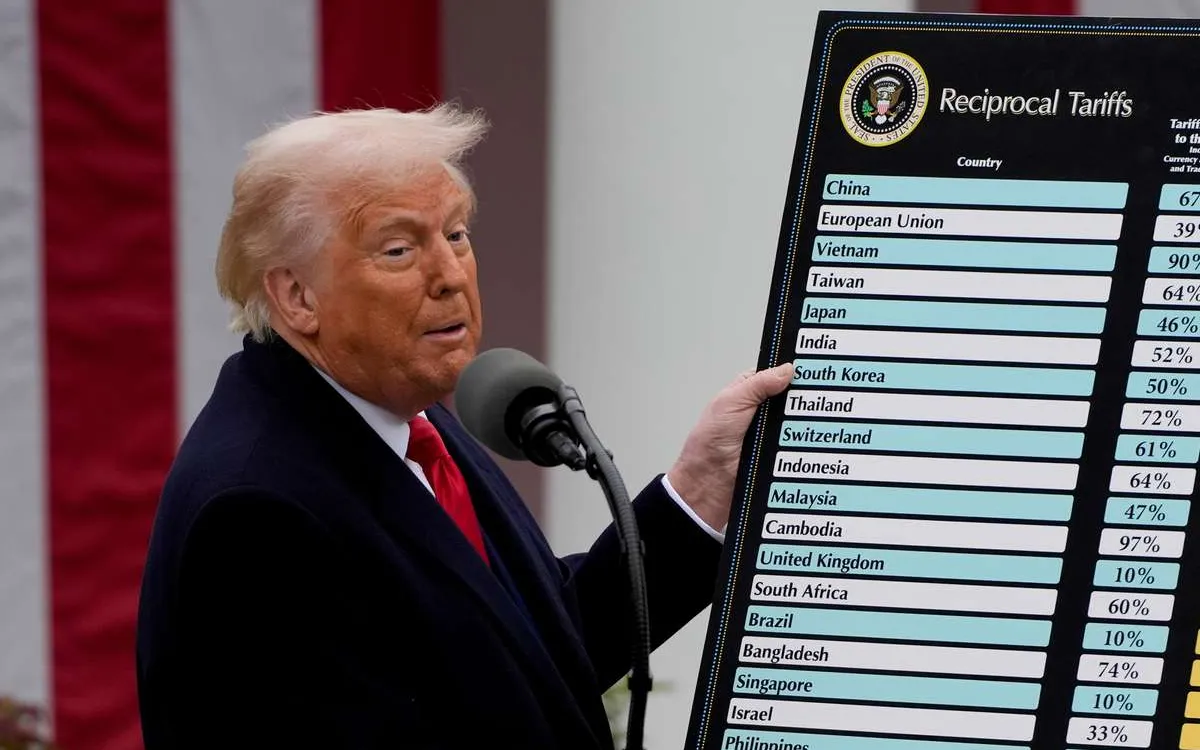

On Wednesday, the U.S. is facing a critical reciprocal tariffs deadline after a 90-day pause on elevated tariffs, dubbed “Liberation Day.” This deadline marks the point at which the U.S. must negotiate new trade agreements with various trading partners. If negotiations fail, tariffs will revert to the levels announced in April. While President Trump has successfully negotiated trade deals with the U.K. and Vietnam, several other nations have yet to finalize their agreements. Notably, Trump has ended negotiations with Canada, leading to uncertainty about whether tariffs will be reimposed or if the deadline will be extended for other countries that have not reached an accord.

Investors are also looking forward to the release of the minutes from the June Federal Reserve meeting, scheduled for Wednesday. These minutes will provide crucial insights into how Federal Reserve officials are assessing the current economic landscape. As central bankers analyze economic data, they will be considering how best to adjust interest-rate policy in response to evolving market conditions. This information will be vital for investors as they navigate potential shifts in monetary policy.

Another highlight this week is the commencement of Amazon Prime Day on Tuesday. Following a record-breaking event last year, Amazon has expanded this year’s sale to four days, a move that could significantly boost its sales figures once again. Investors will be watching how this event unfolds, given its historical impact on retail sales.

In terms of corporate earnings, this week will feature reports from significant players in the market. On Thursday, Delta Air Lines is set to announce its earnings following a quarterly sales increase attributed to higher passenger revenue. Similarly, Conagra Brands, the parent company of Slim Jim, will report earnings on the same day. This follows a previous quarter where the company faced challenges, including declining sales and profits due to supply constraints. Additionally, Levi Strauss will also provide its quarterly earnings update, navigating the complexities of tariffs and their impacts on operations.

Here’s a quick overview of key events scheduled for this week:

Monday, July 7: Nothing scheduled Tuesday, July 8: Amazon Prime Day begins, Consumer credit (May), NFIB small business optimism index (June), Key Earnings: Aehr Test Systems (AEHR) Wednesday, July 9: U.S. reciprocal tariffs deadline, Wholesale inventories (May), Minutes for June FOMC meeting, Key Earnings: AZZ (AZZ) and Bassett Furniture (BSET) Thursday, July 10: Initial jobless claims (Week ending July 5), Key Earnings: Delta Air Lines, Conagra Brands, Levi Strauss Friday, July 11: Monthly U.S. federal budget (June), Amazon Prime Day endsStay tuned as we monitor these pivotal economic events and their implications for the markets. This week is shaping up to be critical for investors looking to navigate the complexities of the current economic climate.