In a significant move for the tech industry, Super Micro Computer has finally submitted its annual report, which was originally due in August 2023. This filing has allowed the company to avoid the risk of being delisted from the Nasdaq. On February 25, Super Micro submitted its annual report for fiscal 2024, which ended on June 30, along with the financial results for the first two quarters of fiscal 2025.

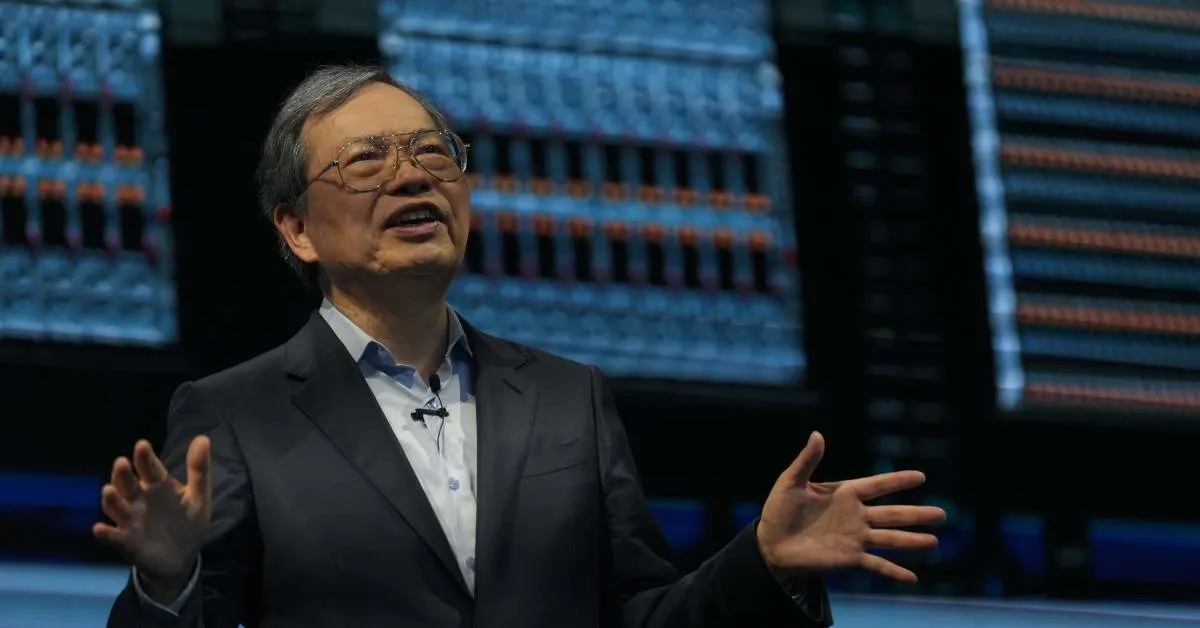

According to a news release from the company, Super Micro has regained compliance with the Nasdaq’s filing requirements. “Today’s filings represent an important milestone,” stated Charles Liang, the Chief Executive Officer of Super Micro. He emphasized that with the company's financial reporting now up to date, they can concentrate on executing their successful growth strategy, which is built on technology, product and solution innovations, and a commitment to green computing.

Liang also highlighted the company's plans to ramp up investments across various departments, including engineering, sales, finance, accounting, compliance, and operations. This investment strategy aims to fulfill Super Micro's ambitious goals in its Data Center Building Block Solution (Supermicro 4.0) and achieve its revenue targets. Following the filing, Super Micro's stock surged by 12.2% on February 26 but then experienced a decline of nearly 16% the following day.

Specializing in server hardware, Super Micro integrates Nvidia's GPUs into its servers, which are subsequently supplied to clients, including major cloud-service providers. Nearly a year ago, Super Micro was thriving, with its stock peaking in March 2024 amid the AI and data-center boom. However, since that peak, the stock has plummeted by 64%.

The company’s troubles began last summer when Hindenburg Research, a short-seller, published a report alleging significant accounting discrepancies and undisclosed related-party transactions. Following this, Super Micro announced a delay in filing its Securities and Exchange Commission Form 10-K for the fiscal year ending June 30. The situation escalated in October when Super Micro’s auditor, Ernst & Young, resigned due to governance and transparency concerns. Despite an investigation revealing “no evidence of misconduct,” the company was subsequently dropped from the Nasdaq 100 Index in December.

For its fiscal second quarter, which ended on December 31, Super Micro reported earnings per share of 51 cents, falling short of the Wall Street analyst consensus estimate of 58 cents. However, the company’s revenue for the quarter was $5.68 billion, surpassing the consensus estimate of $5.65 billion. On February 11, Super Micro announced a bold revenue projection of $40 billion for fiscal 2026. This optimistic outlook helped boost the stock in the following week.

Liang noted that with Super Micro's leading direct-liquid cooling technology, the company is well-positioned to capitalize on the growing demand for AI infrastructure designs, particularly with the anticipated adoption of Nvidia Blackwell technology. He projects that fiscal 2025 revenue could reach between $23.5 billion and $25 billion, ultimately aiming for $40 billion in fiscal 2026. In fiscal 2024, the company’s revenue more than doubled, increasing from $7.12 billion to $14.99 billion.

Following the recent filings, analysts have begun revisiting their evaluations of Super Micro stock. Barclays reinstated coverage with an equal weight rating and a price target of $59. The analyst highlighted that the removal of the potential delisting overhang allows the stock to trade based on fundamentals. While acknowledging Super Micro's leadership in AI servers and direct liquid cooling, Barclays cautioned that the company's competitive edge may be diminishing.

Mizuho Securities also reinstated coverage with a neutral rating and a price target of $50. Analysts believe that Super Micro is well-positioned due to its priority component allocations for enterprise and government markets, but they recognize the increasingly competitive landscape, particularly against rivals like Dell Technologies.

As of late February, Super Micro stock has seen a year-to-date increase of over 40%. On February 28, the stock fluctuated within a range of less than $39 to nearly $43.50, reflecting the ongoing volatility in the market.