On Wednesday evening, stock futures remained relatively unchanged following the Federal Reserve's decision to hold interest rates steady. This decision comes amidst growing concerns about rising inflation and increasing risks of unemployment. Specifically, S&P 500 futures dipped by 0.1%, as did the Nasdaq-100 futures, while futures tied to the Dow Jones Industrial Average fell by 52 points, or 0.1%.

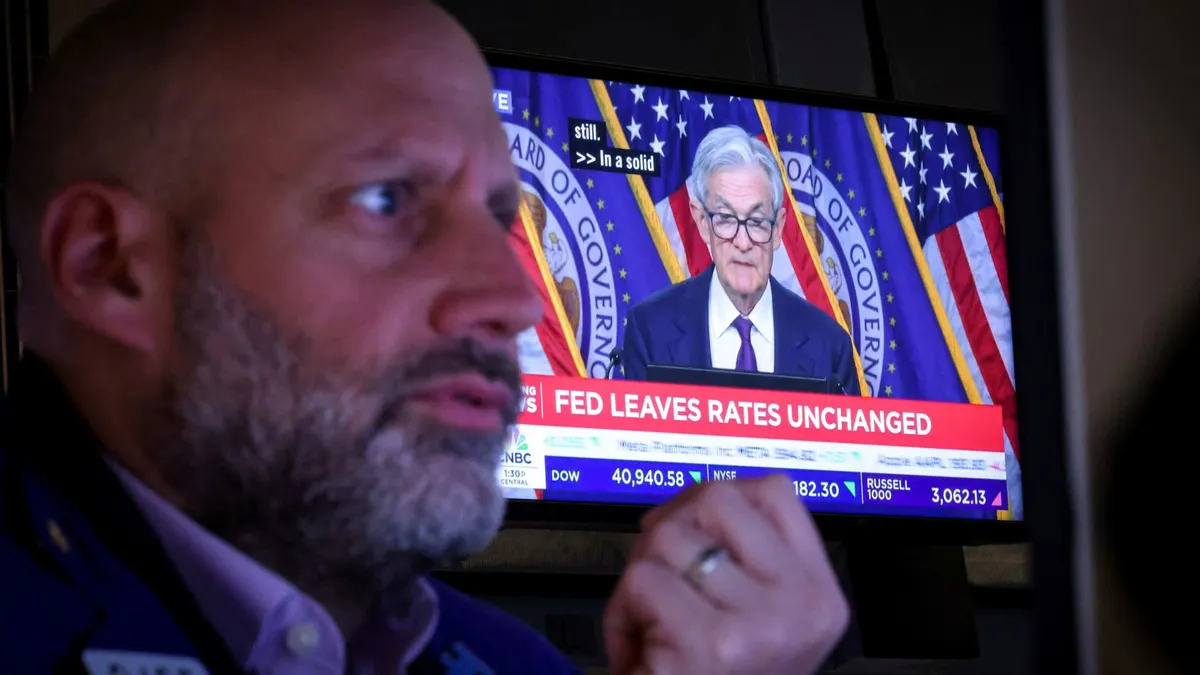

The Federal Reserve announced it would maintain its benchmark overnight borrowing rate between 4.25% and 4.5%. This decision was widely anticipated and marks the continuation of this rate range since the central bank's meeting in December, where it cut interest rates by a quarter percentage point. In its post-meeting statement, the Fed acknowledged an increase in uncertainty regarding the economic outlook. The committee expressed that the risks associated with both sides of its dual mandate—namely inflation and unemployment—have escalated.

During a press conference, Fed Chair Jerome Powell dismissed the notion of a preemptive rate cut aimed at mitigating potential impacts from President Donald Trump's tariffs. He emphasized that inflation remains above target levels, stating, "We actually don't know what the right responses to the data will be until we see more data." This highlights the Fed's cautious approach amidst conflicting economic signals.

Chris Zaccarelli, Chief Investment Officer at Northlight Asset Management, remarked on the Fed's predicament, noting the dual pressures of rising inflation and a potential economic downturn. He warned that markets are increasingly likely to fret over a recession. Zaccarelli suggested that without new trade agreements before the expiration of the tariff pause, a repeat of early April's market decline could be imminent.

In the wake of the Fed's decision, the S&P 500 experienced fluctuations but ultimately closed 0.43% higher, buoyed by a significant rise in Nvidia, which surged over 3% after reports indicated the Trump administration is considering lifting trade restrictions on semiconductor chips. Additionally, the tech-heavy Nasdaq Composite gained 0.27%, while the blue-chip Dow Jones Industrial Average climbed by 0.7%.

As investors look to the future, several key economic reports are set to be released on Thursday. Notably, the weekly jobless claims data will be published before the market opens at 8:30 a.m. ET, followed by the New York Fed Survey of Consumer Expectations later in the day. This week is also packed with earnings reports, including those from energy giant ConocoPhillips and media powerhouse Warner Bros. Discovery, both expected to report before the market opens. Meanwhile, Paramount Global and travel company Expedia are set to release their earnings after the market closes.