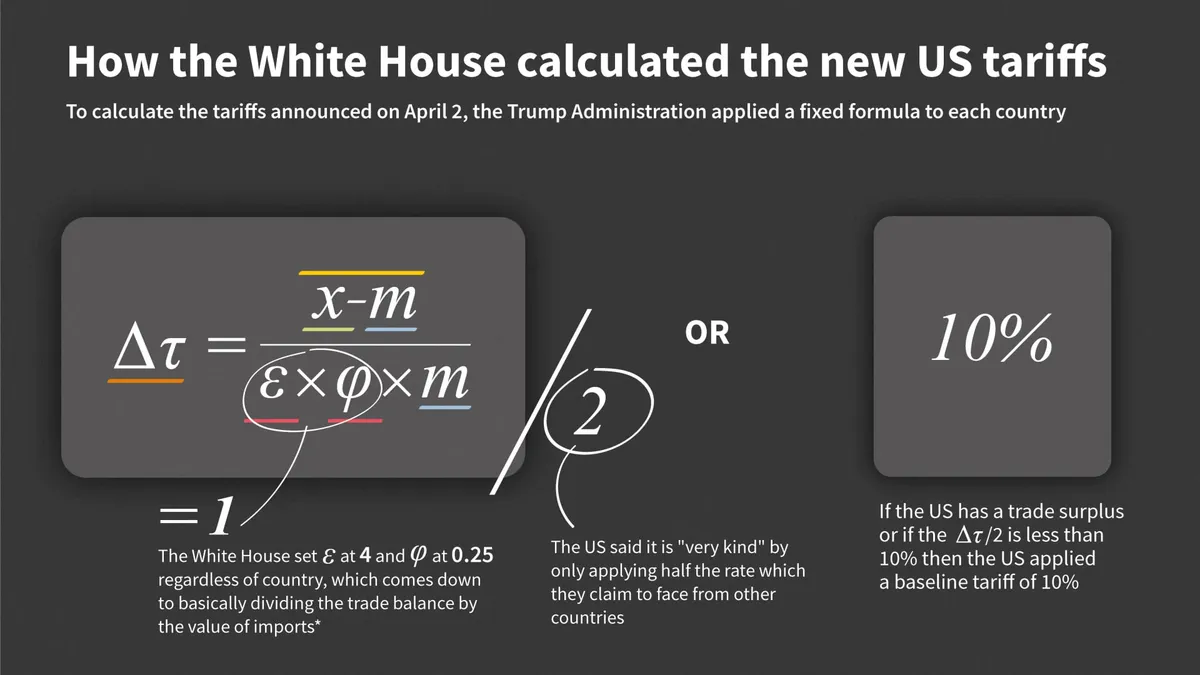

The recent tariff announcement by President Donald Trump has sent ripples through the financial markets, raising many questions among economists regarding its underlying formula. Experts assert that this formula is based on flawed assumptions, leading to inflated tariff rates imposed on various countries. The primary metric at the heart of Trump's tariff strategy is the U.S. trade deficit, which is divided by a country's exports and then halved to determine the applicable tariff rates.

According to the Office of the United States Trade Representative, Trump's comprehensive reciprocal tariff plan stems from a simplistic formula that economists contend miscalculates the actual economic implications. In addition to this formula, Trump has enacted a baseline tariff of 10% on nearly every country, creating a complex landscape for international trade.

Senior fellows Kevin Corinth and Stan Veuger from the American Enterprise Institute have scrutinized Trump's methodology, particularly regarding the elasticity rate used in his calculations. They argue that the formula assumes an elasticity of import prices concerning tariffs at approximately 0.25. However, the economists believe this figure should be adjusted closer to 1.0 (specifically, 0.945) to reflect reality accurately. Their analysis highlights a critical oversight: the elasticity was based on the reaction of retail prices to tariffs rather than on import prices, which is the correct metric to use.

The implications of adjusting the elasticity assumptions within Trump's tariff formula are significant. If recalibrated, it is projected that no country's tariff would exceed 14%, with most nations retaining the baseline 10% tariff established by the Trump administration. For example, under the current tariff plan, Lesotho faces the highest rate of 50%. However, if the elasticity assumptions are modified, the actual tariff for Lesotho would drop to 13.2%.

A separate report released by the Cato Institute also points out significant flaws in the tariff formula used by Trump. This report indicates that the trade-weighted average tariff rates cited by the Trump administration are inflated compared to actual rates. For instance, while the Cato Institute notes the trade-weighted average tariff rate from China in 2023 stands at a mere 3%, the Trump administration claimed it to be as high as 67%.

As the debate surrounding Trump's tariff announcement continues, it is essential to scrutinize the economic formulas and assumptions that underpin such significant policy decisions. Understanding these flawed assumptions will not only help clarify the current trade landscape but also guide future discussions on international trade relations.