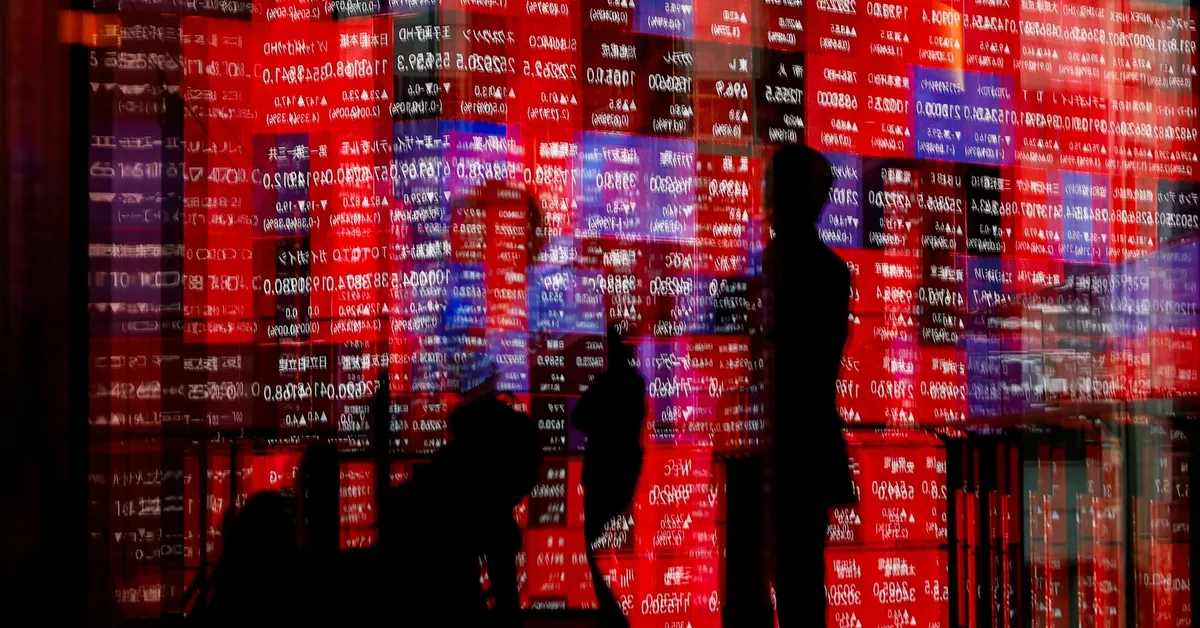

On September 10, 2023, Asian stocks surged, following the upward trend set by Wall Street, as traders adjusted their expectations regarding the Federal Reserve's monetary policy. The anticipation of a soft U.S. labor market has led to increased speculation that the Fed will implement a rate cut of at least a quarter point in the upcoming meeting. Futures for the S&P 500 rose by 0.3%, while the European STOXX 50 futures gained 0.2%, reflecting a positive outlook among investors.

As investors prepare for two crucial days of U.S. inflation data, starting later on Wednesday, the U.S. dollar remained relatively stable. Gold prices stabilized after reaching a record high on Tuesday, and crude oil prices continued to climb following Israel's military actions against Hamas leadership in Qatar. Geopolitical tensions remain a significant concern, especially after Poland took measures to enhance its air defenses in response to Russian airstrikes in western Ukraine.

According to the CME Group's FedWatch Tool, traders have nearly priced in a rate cut by the Fed for next Wednesday, with an 8.4% chance being assigned to a more aggressive half-point reduction. Just a week earlier, the odds of the Fed maintaining current rates were set at 7%. However, disappointing monthly payroll figures prompted investors to believe that the Fed would need to act promptly to bolster the economy.

The upcoming producer and consumer inflation reports on Wednesday and Thursday will be critical in shaping market sentiment. Kyle Rodda, a senior financial markets analyst at Capital.com, noted that an unexpected rise in inflation could unsettle markets and alter the current outlook on rate cuts, particularly for the following months. The rapid decline in U.S. economic indicators, especially in the job sector, has contributed to the aggressive easing expectations from the Fed, which investors seem to believe will suffice to avert a recession.

In addition to economic factors, a recent court ruling temporarily blocking former President Donald Trump from removing Federal Reserve Governor Lisa Cook has captured investor attention. This unprecedented legal challenge could have significant implications for the Fed's long-standing independence.

On Wednesday, U.S. Treasury bonds fell for the second consecutive day, resulting in higher yields. The yield on the 10-year Treasury note increased by 1 basis point to 4.088%, following a nearly 3 basis point rise on Tuesday. Similarly, Japanese government bond yields saw a slight uptick, with the 10-year yield rising 0.5 basis points to 1.565% after a successful auction of five-year debt. Bond yields typically rise when prices decrease.

The U.S. dollar index, which assesses the currency's strength against six major rivals, dipped slightly to 97.707. The greenback remained stable at $1.1715 against the euro and dropped 0.07% to 147.31 yen. The European Central Bank is anticipated to maintain its current policy during its meeting on Thursday, despite earlier mixed sentiments regarding potential rate adjustments. Recent data suggests that inflation remains close to the 2% target, with unemployment rates hitting record lows.

Looking ahead, the Bank of Japan is set to announce its policy decisions next Friday, with widespread expectations that it will not raise rates at this time. Conflicting reports from Reuters and Bloomberg have surfaced regarding the BOJ's future policy stance, with Reuters indicating a longer wait for tightening measures and Bloomberg suggesting a possible hike within the year. Political dynamics are also being closely monitored, particularly concerning the succession of Japan's Prime Minister and the stability of France's newly appointed government.

Gold prices saw a modest increase of 0.5%, reaching $3,644 per ounce after hitting an all-time high of $3,673.95 just a day prior. In the energy sector, Brent crude futures rose by 1.1% to $67.13 per barrel, while U.S. West Texas Intermediate crude futures also gained 1.1%, settling at $63.34 per barrel. This follows a previous session where prices increased by 0.6% after Israel's military action against Hamas threatened to disrupt ongoing peace negotiations.

As global markets navigate these turbulent waters, the interplay of economic indicators, geopolitical tensions, and political developments will continue to shape investor sentiment and market dynamics.