After a tumultuous three days of global market instability reminiscent of the early days of the Covid-19 pandemic, Asian stocks experienced a notable recovery on Tuesday. This rebound occurred despite ongoing trade tensions fueled by President Trump's recently imposed tariffs.

In a proactive move before the markets opened in China, the government introduced a series of measures aimed at stabilizing stock prices. This intervention helped lift share prices in Hong Kong, which had suffered a significant drop of 13.2 percent just a day prior, witnessing a rise of 2 percent on Tuesday. Additionally, benchmarks across mainland China saw modest gains, recovering from substantial declines experienced the previous day.

The recovery trend extended to Japan, where the Nikkei 225, a crucial benchmark for the Japanese economy, surged by 6 percent, recouping a portion of its prior losses. This positive sentiment in Asian markets was bolstered by remarks from Treasury Secretary Scott Bessent, who announced plans to initiate discussions with the Japanese government regarding the ongoing tariff situation.

In South Korea, the Kospi index reflected similar optimism, rising approximately 1.5 percent. This uptick across various Asian markets illustrates a collective effort to regain stability amidst the backdrop of escalating trade disputes.

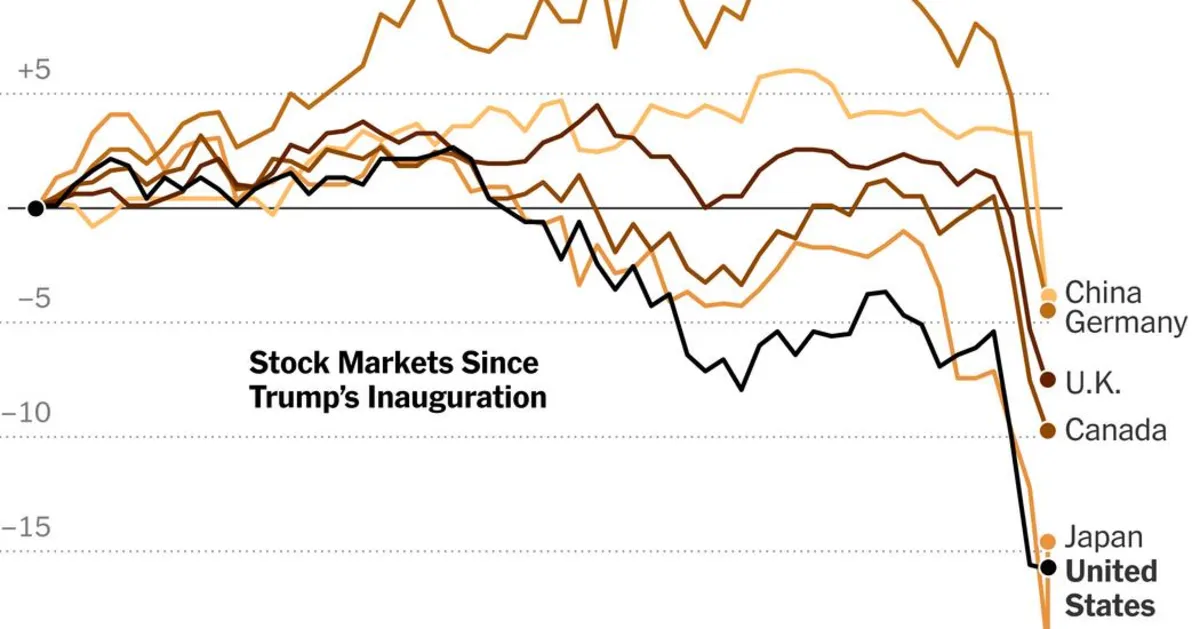

The global markets faced significant disruption last week following President Trump’s announcement of sweeping new tariffs. This included a base tax of 10 percent on American imports, in addition to significantly higher rates targeting numerous other countries. In response, various nations implemented their own tariffs on U.S. goods or issued threats of retaliation. Notably, China retaliated decisively on Friday, matching a new 34 percent tariff on many American imports.

As the situation continues to evolve, market analysts will closely monitor the international economic landscape, particularly the impact of tariffs on trade relations and stock market performance.