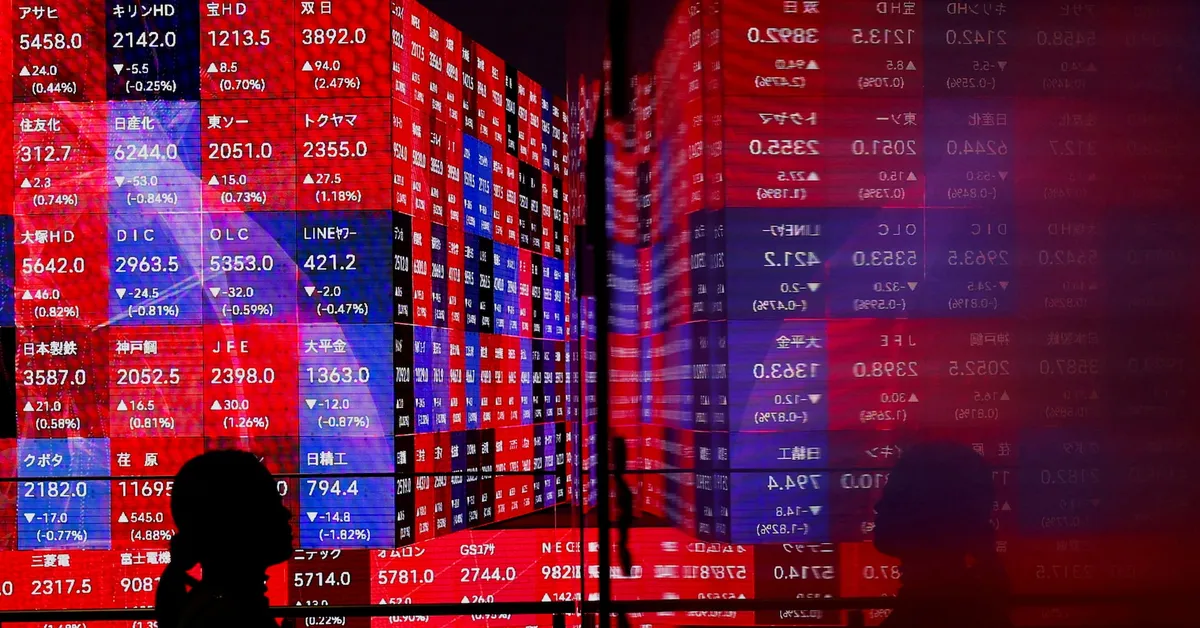

SINGAPORE, June 26 (Reuters) - Asian stocks experienced fluctuations, while the U.S. dollar faced pressure on Thursday. The recent discussions regarding the potential early appointment of the next Federal Reserve Chair by President Donald Trump raised concerns about the independence and credibility of the U.S. central bank. Reports indicated that Trump is considering announcing a replacement for Federal Reserve Chair Jerome Powell as early as September or October, which could undermine his current position.

This potential move is interpreted by analysts as an attempt to manipulate monetary policy through a shadow Fed chair, even before Powell's term concludes in May 2026. Although market sentiments have been soothed by a ceasefire between Israel and Iran—which has reduced the risks of disruptions in the oil trade—traders remain cautious about Trump’s imminent July 9 deadline for imposing tariffs on trading partners and his increasing pressure on the Fed.

European stock futures indicated a muted opening, while currency markets dominated the focus. The euro strengthened, reaching its highest level since September 2021 at $1.6837. Additionally, the Swiss franc climbed to a decade-high, and the Japanese yen appreciated by 0.3% to 144.815 per dollar. Trump's ongoing criticisms of Powell for not implementing interest rate cuts, along with his suggestions of potentially firing him, have eroded investor confidence in U.S. assets and raised concerns about the central bank's independence.

Market analyst Tony Sycamore from IG suggested, “It’s a given that Trump's pick to succeed Powell will likely be dovish and supportive of Trump's agenda to lower interest rates.” This situation could reignite earlier concerns regarding the Fed's independence, which has historically undermined confidence in both the Fed and the U.S. dollar.

The dollar index, which measures the U.S. currency against six major rivals, languished at its lowest level since March 2022. This index has dropped by 10% this year as investors, wary of the implications of Trump's tariffs on U.S. growth, seek alternative investments. Financial markets continue to be jittery due to Trump’s unpredictable trade policies, especially with the July 9 deadline for trade agreements looming.

During his recent congressional testimony, Powell mentioned that Trump’s tariff plans might lead to a temporary spike in prices. However, he also cautioned that the risk of triggering more persistent inflation is significant enough for the central bank to tread carefully regarding further rate cuts. Fed officials currently anticipate a reduction in interest rates this year, with two cuts already factored into market expectations. However, the timing remains uncertain as they await clarity on the impending trade deadlines and the full impact of the tariffs.

As U.S. yields decline and speculation regarding the next Fed chair grows, investors are weighing the potential effects of a more dovish Fed on the market. Ben Bennett, Asia-Pacific investment strategist at Legal & General Investment Management, noted, “Tomorrow’s PCE inflation data will be crucial.” Current market analyses reveal that traders are now pricing in nearly a 25% chance of the Fed cutting rates at its end-of-July meeting, a significant increase from last week’s 12.5% likelihood.

The two-year U.S. Treasury yield, which typically correlates with interest rate expectations, decreased by 1.5 basis points to 3.764%, marking its lowest level in seven weeks. Uncertainties surrounding the impact of tariffs on inflation maintain a cautious stance among central banks, particularly the Fed. Strategists at Bank of America highlighted that the risks to global growth, stemming from trade wars and geopolitical developments, remain pertinent. They stated, “We are closely monitoring fiscal policies across key countries that may influence global interest rates, as unsustainable fiscal dynamics could precipitate a crisis in bond markets.”

In the commodities sector, oil prices rose on Thursday, continuing their recovery after a tumultuous month driven by the conflict between Israel and Iran. Brent crude futures increased by 0.37% to $67.93 a barrel, while U.S. West Texas Intermediate crude (WTI) gained 0.45% to $65.21.

Editing by Shri Navaratnam and Lincoln Feast.