In recent statements, President Donald Trump has asserted that the Republican-backed mega tax and spending cut legislation will completely eliminate taxes on federal Social Security benefits. However, this claim is misleading and, at best, overstates the potential benefits for seniors if either the House or Senate proposals are enacted. This article aims to clarify Trump's remarks and examine the actual provisions of the proposed legislation.

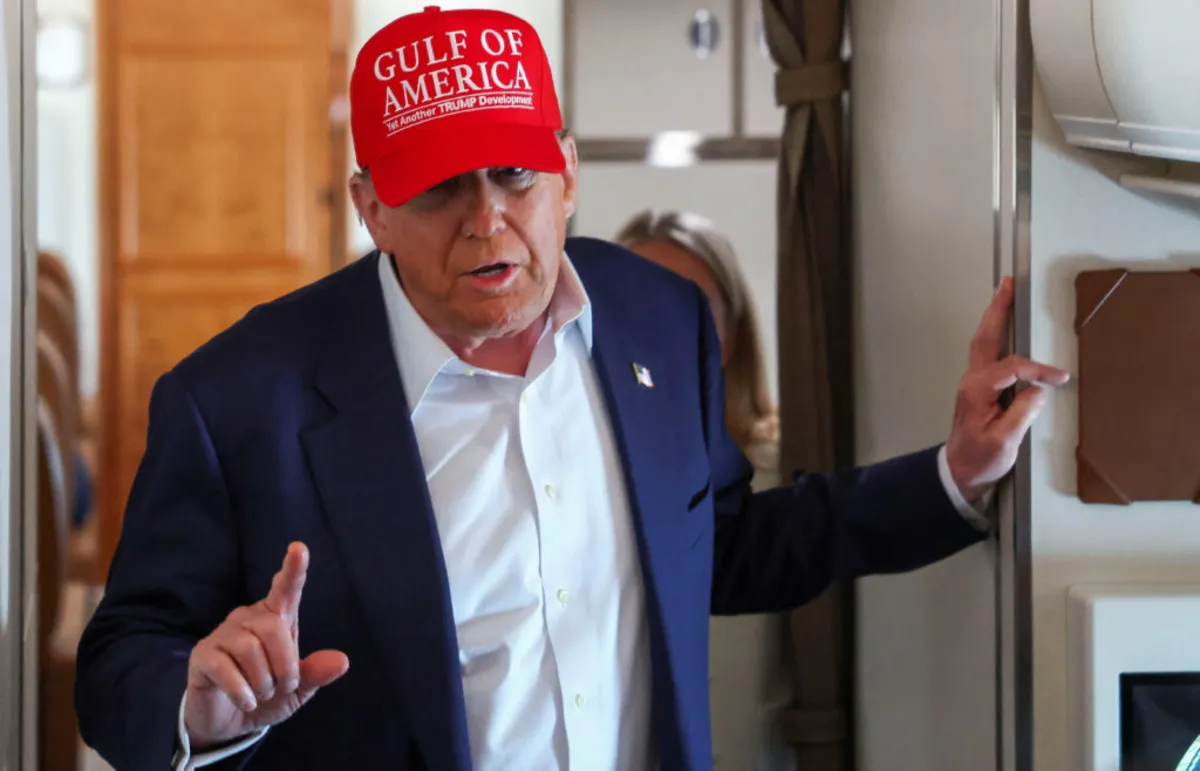

Throughout his 2024 campaign, President Trump has consistently promised voters that he would abolish taxes on Social Security. As his significant legislative package has progressed through Congress, he has reiterated this point. During a recent appearance on Fox News' "Sunday Morning Futures," Trump claimed, "the bill includes no tax on tips, no tax on Social Security, no tax on overtime."

Contrary to Trump's assertions, both the Senate and House have passed their own versions of a temporary tax deduction aimed at seniors aged 65 and older. This deduction applies to all types of income, not limited to Social Security benefits. Notably, not all seniors receiving Social Security will qualify for this deduction. Exclusions apply to low-income seniors who do not currently pay taxes on Social Security, those who opt to claim their benefits before turning 65, and individuals whose income exceeds a specified threshold.

The Senate proposal features a temporary deduction of $6,000 for seniors over 65, while the House proposal offers a slightly lower deduction of $4,000. Additionally, the Senate's plan would eliminate Social Security tax liability for seniors with adjusted gross incomes of $75,000 or less, or $150,000 for married couples filing jointly. If these proposals are signed into law, the deductions are scheduled to last for four years, from 2025 to 2029, with a phase-out mechanism as income levels increase.

The White House has recently highlighted a new analysis from the Council of Economic Advisers, stating that 88% of seniors receiving Social Security will pay no taxes on their benefits. They also noted that the Senate's $6,000 senior deduction is projected to benefit 33.9 million seniors, including those who do not claim Social Security. Moreover, it is estimated that this deduction would lead to an average increase of $670 in after-tax income for qualifying seniors.

However, experts like Garrett Watson, director of policy analysis at the Tax Foundation, caution against conflating a tax deduction with the idea of eliminating taxes on Social Security benefits entirely. Watson pointed out that while the deduction provides some financial relief, it does not equate to a full repeal of the tax on Social Security benefits, which could lead to confusion and disappointment among seniors.

The notion of completely eliminating taxes on Social Security benefits raises significant economic concerns. According to the Penn Wharton Budget Model from the University of Pennsylvania, such a move could reduce federal revenues by $1.5 trillion over a decade and increase the federal debt by 7% by 2054. Furthermore, it could hasten the depletion of the Social Security Trust Fund, moving its projected depletion date from 2034 to 2032.

Discussions surrounding taxes on Social Security are just one aspect of the broader legislative package, which the Congressional Budget Office estimates could increase federal deficits by nearly $3.3 trillion over the next ten years from 2025 to 2034. Administration officials have claimed that the costs associated with the tax bill would be offset by revenue from tariffs. The CBO has separately estimated that Trump's expansive tariff strategy could reduce deficits by $2.8 trillion over a ten-year span, though this could come with adverse effects on the economy, such as increasing inflation rates and decreasing household purchasing power.

In summary, while President Trump's proposals may offer certain tax deductions for seniors, they do not eliminate taxes on Social Security benefits as claimed. Understanding the details of these legislative measures is crucial for seniors who rely on Social Security and may expect significant tax relief.