On Tuesday, President Trump expressed strong support for a House budget blueprint that aims to facilitate the passage of much of his legislative agenda in what he referred to as "ONE BIG BEAUTIFUL BILL." This budget, which has successfully passed a committee vote, is set to reach the House floor as early as next week. It outlines targets for legislation that would extend tax cuts and increase the federal deficit, while also proposing significant cuts to programs that assist the poor.

House Speaker Mike Johnson faces the challenge of maintaining unity within his caucus, as he can only afford one defection. Some Republicans are pushing for tax cuts, others want to reduce the federal deficit, and some are hesitant about making substantial cuts to social welfare programs. Several Republican lawmakers have already expressed concern over potential cuts to Medicaid and the SNAP food benefit program, which are likely necessary to balance the budget.

President Trump has made statements that could affect support for the bill, such as his recent Fox News interview where he assured that Medicaid would not be “touched.”

In most years, congressional budgets are often symbolic and do not always receive a vote. However, this year, the budget is crucial for Republicans as they seek to pass their agenda through a special process that bypasses a Senate filibuster.

The 10-year budget provides guidelines for tax and spending reductions across various House committees. However, it does not specify how these committees should achieve their targets, leaving that aspect for later in the process.

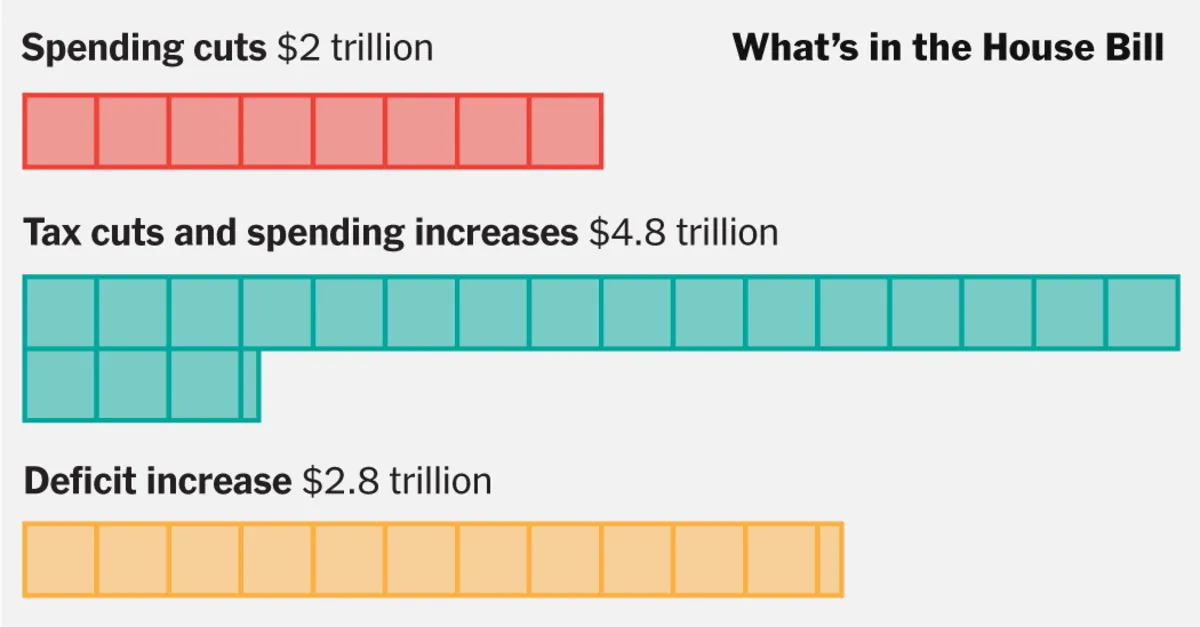

The resolution directs several committees to make at least $1.5 trillion in cuts over a decade to mandatory spending, which does not require Congress to draft appropriations bills to fund programs. An amendment introduced to appease spending hawks requires $2 trillion in total spending cuts or a reduction in allowed tax cuts.

Cuts: At least $880 billion

Medicaid is expected to bear the brunt of these cuts, potentially leading to an 11% reduction in spending over ten years. The committee could also include cuts to Medicare or find savings by reversing Biden-era regulations.

Cuts: At least $330 billion

The committee may need to cut nearly half of its program spending. Altering student loan programs could generate additional revenue, reducing the necessary cuts. Notably, the SAVE student loan repayment plan could be ended, potentially saving $150 billion or more, contingent on the outcome of ongoing litigation.

Cuts: At least $230 billion

The bulk of the cuts would affect food benefits through the Supplemental Nutrition Assistance Program (SNAP), which could face a 21% reduction if targeted alone. Such cuts would likely have significant impacts on beneficiaries.

Additional cuts: At least $562 billion

Four other committees are tasked with making further cuts, with lawmakers instructed to identify an extra $500 billion in spending reductions.

The budget also allocates a modest increase in spending, primarily focused on border security.

Increase: Up to $190 billion

These committees oversee border security programs, with potential increases of $110 billion and $90 billion, respectively. These increases could be offset by raising certain immigration fees.

Increase: Up to $100 billion

This increase represents 1% of projected defense spending over the next decade, likely expanding military involvement in border security.

Potential Tax Reductions: Up to $4.5 trillion

Extending $4 trillion in expiring tax cuts from the first Trump administration is the bill's primary focus. The budget allows the Ways and Means Committee to decrease federal revenue by up to $4.5 trillion over ten years, possibly introducing new tax cuts as well.

Due to the imbalance between tax cuts and spending increases versus spending cuts, the budget would add $2.8 trillion to deficits over the next decade. It could potentially increase the national debt by an estimated $3.4 trillion due to the costs associated with increased borrowing. The House bill assumes aggressive economic growth to cover much of this increase, but budget experts question the realism of these assumptions.