Throughout his presidency, former President Donald Trump frequently touted the performance of the stock market as a key indicator of his administration's success. However, recent developments have caused a noticeable shift in how he addresses this economic barometer. In this article, we explore the changing dynamics of Trump's relationship with the stock market, particularly in light of recent market fluctuations and broader economic challenges.

During his time in office, Trump often celebrated record-high stock market gains, using them to bolster his claims of economic prosperity and to rally support among his base. The former president frequently pointed to the Dow Jones Industrial Average and other major indices as evidence of his successful economic policies, particularly tax cuts and deregulation measures. His administration's narrative was heavily centered on the idea that a rising stock market equated to a thriving economy.

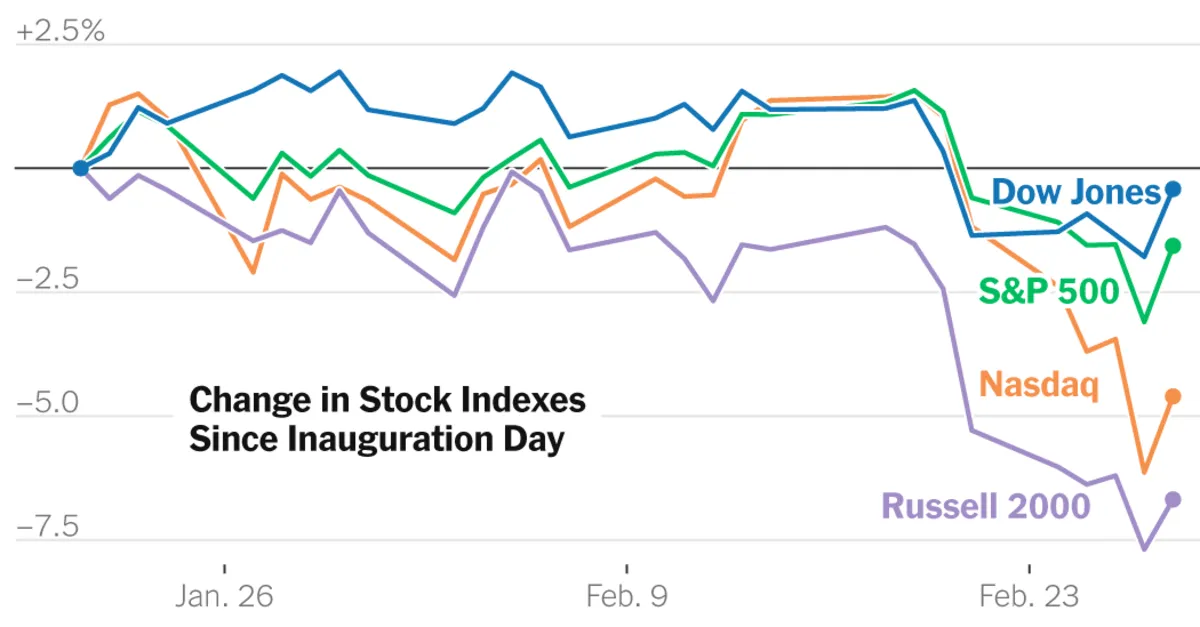

However, as the stock market has experienced increased volatility and uncertainty in recent months, Trump’s enthusiasm for discussing market performance has waned. Factors such as inflation, interest rate hikes, and geopolitical tensions have contributed to a more unpredictable market landscape, making it challenging for Trump to maintain his previous narrative. Investors are on edge, and the once-reliable talking point of a booming stock market is losing its luster.

The current economic conditions present a stark contrast to the thriving markets of 2017-2019. With rising inflation and potential recession fears, the stock market is no longer the unassailable proof of economic success that it once was. This shift has left Trump and other political figures scrambling for new strategies to address voters’ concerns about the economy without relying on stock market performance as a metric of success.

As Trump prepares for future political endeavors, it remains to be seen how he will navigate the complexities of the current stock market situation. Will he shift his focus to other economic indicators, or will he attempt to reclaim the narrative surrounding the stock market? Regardless of his approach, the changing landscape highlights the need for political figures to adapt their messaging in response to economic realities.

The once-favored topic of the stock market is now a double-edged sword for Trump. As the market continues to experience ups and downs, his ability to leverage this talking point will be crucial in shaping public perception and maintaining political relevance. Understanding the intricate relationship between politics and the stock market will be essential for both Trump and his potential challengers moving forward.