U.S. Treasury Secretary Scott Bessent recently commented on President Donald Trump's suggestion regarding a shift from quarterly to semiannual earnings reports for publicly traded companies. In a post on Truth Social, Trump proposed this significant change, arguing that it would be beneficial for investors as it would allow company executives to concentrate on long-term objectives rather than being preoccupied with short-term metrics.

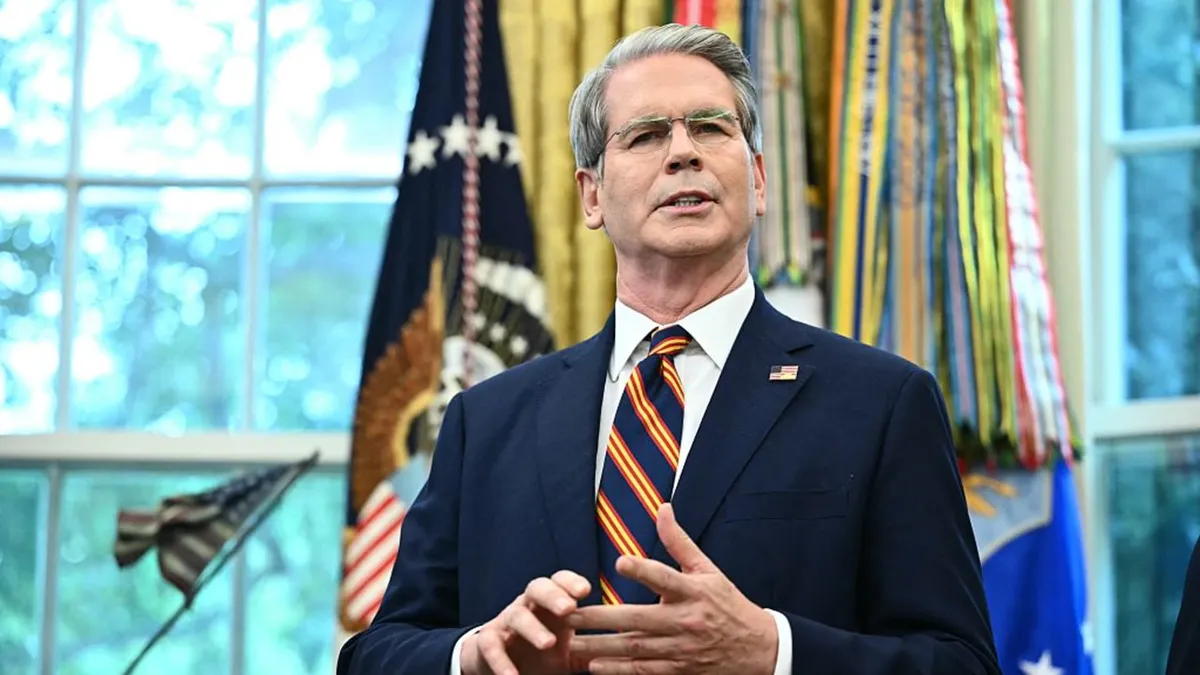

According to Bessent, Trump is aware that both the U.S. and U.K. public markets are facing challenges, and moving towards semiannual reporting could rejuvenate the market while also reducing costs for public companies. This perspective was shared during Bessent's interview with CNBC in London, where he emphasized the potential benefits of this shift without compromising investor interests.

The proposal comes at a time when many companies are opting to stay privately held instead of going public, primarily due to the mounting scrutiny and compliance costs associated with quarterly earnings reports. The statistics are striking: the number of publicly listed companies in the U.S. has plummeted from over 7,000 in 1996 to fewer than 4,000 in 2020. This decline raises concerns about the vitality of the public markets and the implications for investors.

Trump's suggestion to eliminate quarterly earnings reports also aims to align the U.S. with various foreign jurisdictions that already utilize a semiannual reporting system. He highlighted the stark contrast between the long-term management perspective of companies in China and the short-term focus prevalent in the U.S. market. "Did you ever hear the statement that, 'China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis??? Not good!!!'" Trump stated, reflecting on the need for a more strategic approach in corporate governance.

However, the idea of scrapping quarterly reports has faced criticism from some investors. The Council of Institutional Investors (CII), which represents pension funds invested in stocks, has expressed concerns that moving away from quarterly reporting might not adequately safeguard investor interests. They argue that regular financial disclosures enhance transparency, helping investors make informed decisions.

Interestingly, foreign companies listed in the U.S. under the foreign private issuer scheme, such as Arm and Spotify, are already exempt from quarterly reporting obligations, although some choose to report quarterly voluntarily. CII has pointed out that these exemptions might undermine effective corporate governance, highlighting the complexities of the current regulatory landscape.

The potential move away from quarterly reporting may also appeal to European companies considering a U.S. listing. Over the past decade, several high-profile firms have left their home markets to take advantage of higher valuation levels and regulatory benefits in the U.S. If the U.S. were to adopt a semiannual reporting system, it could further reduce compliance costs, making the market more enticing for European businesses.

Mike Bienenfeld, a lawyer specializing in SEC compliance at Linklaters, remarked, "I don't think that this is a game-changing development if it were to be implemented, but it will definitely come into the mix of considerations for a company thinking about if and how they want to list in the U.S." This highlights the nuanced implications of Trump's proposal on corporate strategies and international market dynamics.

In conclusion, while Trump's proposal to move to semiannual earnings reports could reshape the landscape of U.S. public companies, it remains to be seen whether this shift will attract more firms to list in the U.S. or enhance investor protections. As Bessent noted, "It's tough being popular," indicating the complexities and challenges inherent in any regulatory changes that could impact market behavior.