When it comes to investing, the names holmium, europium, ytterbium, thulium, and erbium might not be found in traditional financial literature. However, these rare earth elements are rapidly becoming a significant part of the vocabulary on Wall Street. As investors look for opportunities in emerging markets, understanding the role of these minerals is crucial.

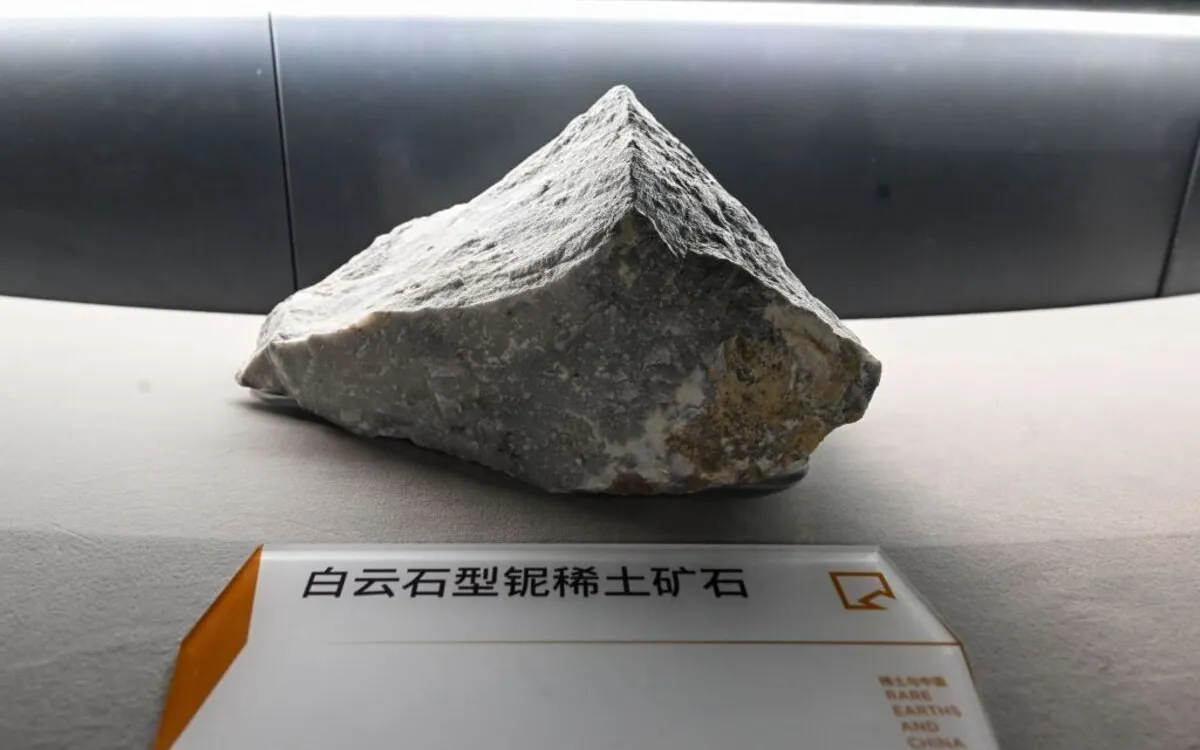

Rare earth elements are a group of 17 metallic components that are essential for various advanced technologies. They are used in the production of advanced weaponry, cutting-edge computer chips, and high-tech vehicles. The growing demand for these minerals is directly linked to advancements in technology and the push for greener energy solutions.

China currently holds a dominant position in the global market for rare earth elements, controlling approximately 70% of the mining operations and nearly 90% of the processing capabilities. This significant control allows China to influence prices and availability, making it a key player in the global supply chain of rare earths.

The increasing reliance on rare earth elements in high-tech industries presents both challenges and opportunities for investors. As nations seek to secure their supply chains, the importance of diversifying sources for these minerals has never been more apparent. Investors who understand the landscape of rare earth mining and processing could benefit significantly from the potential growth in this sector.

Looking ahead, the investment potential in rare earth elements is vast. As governments and companies prioritize sustainability and technological advancement, the demand for materials like holmium and europium is likely to surge. For investors, this means keeping a close eye on the evolving market dynamics and the geopolitical factors that may affect supply and pricing.

In conclusion, while holmium, europium, ytterbium, thulium, and erbium may not be household names in investing circles, their significance is undeniable. Understanding their role in modern technology and the implications of China's control over their supply can open new doors for savvy investors seeking to capitalize on this emerging market.