The stock market experienced a significant boost today as President Trump announced a 90-day pause on reciprocal tariffs, during which a 10% baseline tariff on imports will remain in effect. This pivotal news triggered a surge in both the S&P 500 and the Nasdaq Composite, which rose by 9.5% and 12.2%, respectively. Investors are hopeful that this development indicates a potential easing of recent trade tensions that have negatively impacted the market.

The most substantial gains were observed in the technology sector, which had faced significant challenges earlier this year. While tech stocks had performed admirably in 2023 and 2024, the rising risks associated with an economic slowdown and concerns over potential peaks in AI spending had taken a toll. Notably, Nvidia, recognized for its high-end graphics processing units essential for training and running AI applications, has been among the most affected stocks this year.

Nvidia's share price soared by an impressive 171% in 2024, contributing to a staggering 684% increase since 2022. Despite this remarkable growth, 2023 has proven to be a challenging year for Nvidia. Concerns arose that major players like Microsoft and Amazon might reduce their investments in AI data centers if the economic conditions deteriorate. Additionally, the introduction of a low-cost AI model, DeepSeek, caused Nvidia shares to plummet nearly 15%.

However, positive developments regarding China contributed to a remarkable 19% surge in Nvidia's stock on April 9. The demand for Nvidia's AI technologies has skyrocketed, with banks like JP Morgan Chase utilizing AI to mitigate risks, pharmaceutical companies exploring AI for drug development, and retailers assessing AI's potential in enhancing supply chain efficiency and preventing theft.

AI's influence is pervasive, as virtually every industry is exploring the potential advantages of integrating AI agents to streamline operations and improve processes. While AI is a relatively recent phenomenon in mainstream applications, its roots trace back decades. Notably, computer scientist Alan Turing was among the pioneers researching AI in the 1950s, leading to a rich cultural discourse around AI's implications, illustrated in works like Isaac Asimov's *iRobot* and *The Terminator*.

The rapid rise of AI was exemplified by the launch of OpenAI's ChatGPT, which became the fastest app to amass one million users following its debut in November 2022. Millions of users now rely on ChatGPT and competing platforms like Google's Gemini for daily insights and support.

This surge in AI activity has significantly benefited companies like Nvidia. Major hyperscalers managing the world's largest data centers have invested heavily in the infrastructure required to meet the surging demand for computing power necessary for AI development. In 2024 alone, tech giants like Microsoft, Google, and Amazon allocated $192 billion in capital expenditures, a substantial increase from $117 billion in 2023. Nvidia has reaped the rewards of this financial commitment, akin to the shovel sellers during the 1800s gold rush.

Nvidia has excelled by providing high-performance software and graphics processing units (GPUs), which are better equipped to handle the demanding workloads associated with AI than traditional central processing units (CPUs). The sales of Nvidia's H100, H200, and the latest Blackwell AI chips have propelled its annual revenue to over $130 billion—a remarkable 114% increase year-over-year, compared to $27 billion in 2023. Furthermore, net income has skyrocketed to nearly $73 billion, up from less than $5 billion in the previous year.

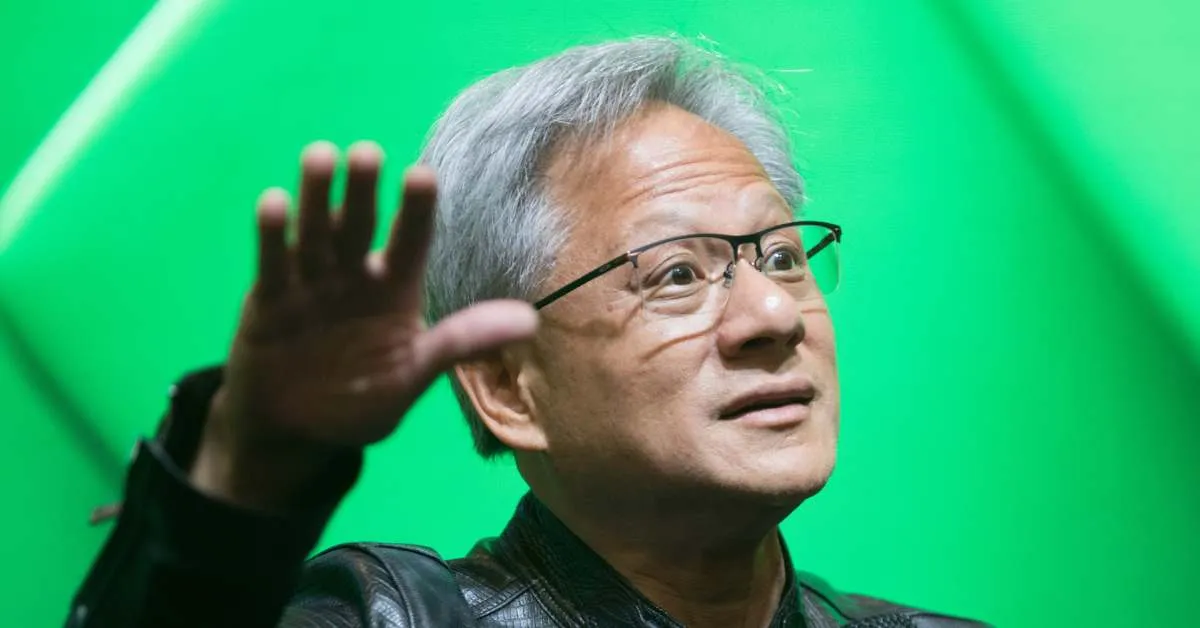

Despite its success, Nvidia faces several challenges heading into 2025. While global demand for its AI chips remains strong, the Chinese market presents significant hurdles. China has historically been a major consumer of semiconductors, but U.S. regulations aimed at limiting the sale of advanced technologies to China have impacted Nvidia's revenue from this key market. CEO Jensen Huang noted that revenue from China has significantly dropped, now representing only half of what it used to be prior to the imposition of export controls.

Compounding Nvidia's challenges are ongoing discussions regarding potential restrictions on the sale of its H20 chip in China, which is critical for major AI players like Alibaba, Tencent, and ByteDance. In the first quarter alone, these companies reportedly ordered $16 billion worth of H20 chips. Fortunately, recent reports suggest that restrictions on the H20 chip may be less likely, thanks in part to Huang's effective lobbying efforts. His attendance at a $1 million dinner with President Trump may have influenced this decision, alongside Nvidia's commitment to invest in new data centers in the U.S.

As the situation unfolds, the prospect of Nvidia continuing to sell the H20 chip in China offers a glimmer of hope for shareholders, potentially alleviating fears of a further sales downturn in one of its most crucial markets.