Nvidia's revenue in 2024 has more than doubled compared to the previous year, significantly beating analysts' expectations. The company anticipates that sales in the current quarter will continue to grow at a faster pace than Wall Street's estimates. This growth is largely attributed to Nvidia's new Blackwell artificial intelligence chip, which has garnered substantial investment from Big Tech companies.

Despite concerns over the efficiency of AI models like DeepSeek, Nvidia remains optimistic, emphasizing that advanced AI models will still require substantial processing power in the long term. Meanwhile, consumer surveys from the Consumer Board and the University of Michigan indicate growing concerns over the economy and inflation. This has led to the 10-year Treasury yield falling below the 3-month note, resulting in an inverted yield curve — a recognized indicator of a potential recession within the next 18 months. As Nvidia continues to generate significant revenue and Big Tech invests heavily in capital expenditures, confidence in the U.S. economy appears to be slightly unstable. It remains to be seen whether the tech sector can provide stability.

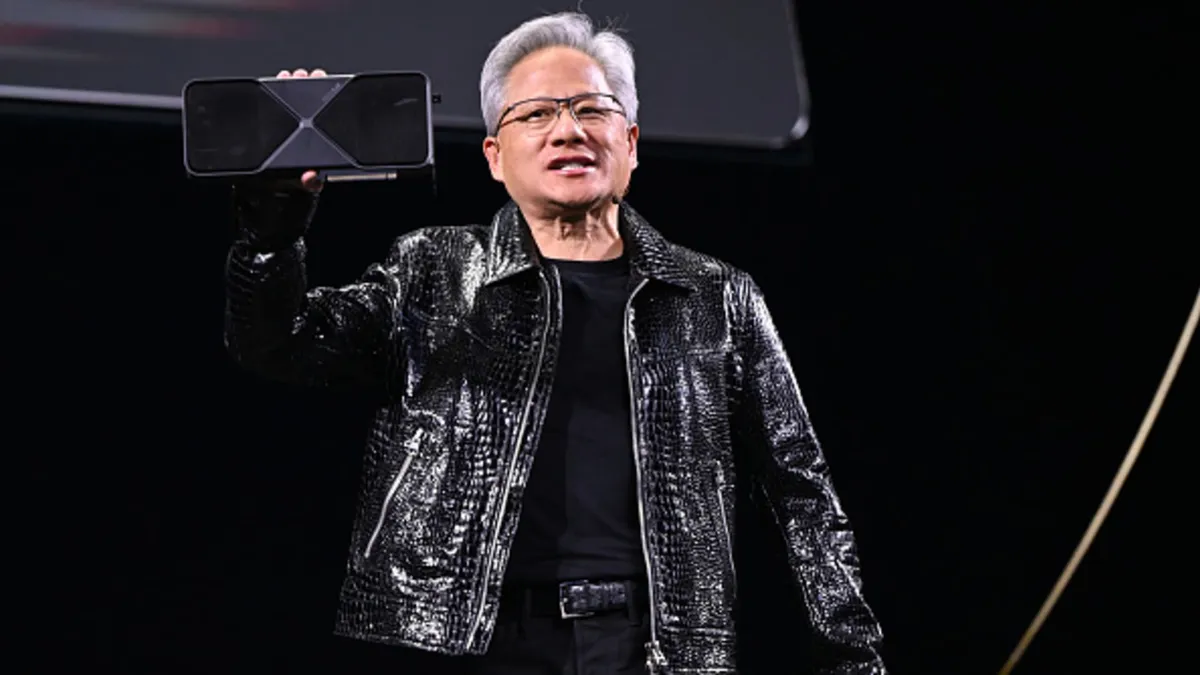

On Wednesday, Nvidia reported fourth-quarter earnings that exceeded Wall Street expectations. The company's net income for the quarter soared to $22.09 billion, marking an 80% increase from $12.29 billion in the same period the previous year, while quarterly revenue rose by 78%. Nvidia also issued guidance for the current quarter that surpasses LSEG estimates. However, the growth rate is decelerating, causing shares to fall by 1.5% in extended trading. Despite this, CEO Jensen Huang is confident that next-generation AI will require 100 times more computing power than older models.

On Wednesday, both the S&P 500 and Nasdaq Composite broke their four-day losing streaks. The broad-based S&P 500 index increased by 0.01%, while the Nasdaq advanced by 0.26%. In contrast, the Dow Jones Industrial Average fell by 0.43%. Asia-Pacific markets exhibited mixed results on Thursday, with Japan's Nikkei 225 rising around 0.3%, even as Seven & i shares plummeted by as much as 12% after the company announced that the founding family failed to secure financing to buy out the convenience store operator.

China is set to hold its annual parliamentary gathering, known as the Two Sessions, starting Tuesday. During the opening meeting, Beijing is expected to lower its annual consumer price inflation target to around 2% from 3% or higher in previous years, according to the Asia Society Policy Institute. Analysts predict that China will increase its budget deficit, allowing for more substantial stimulus measures.

The 10-year Treasury yield fell below the 3-month note in Wednesday's trading, resulting in an inverted yield curve. This is considered a reliable predictor of recessions, with the New York Fed providing monthly updates on this relationship, along with percentage odds of a recession occurring over the next 12 months.

According to data from Goldman Sachs, Nvidia's earnings, released after the bell, are expected to have a significant impact on the stock market over the next two days. Two primary factors contribute to Nvidia's outsized influence this time.

India has been eager for Tesla to establish a manufacturing base in the country. Although the carmaker has been hesitant in the past, it is now showing interest in the market. This coincides with the Indian government's efforts to welcome Tesla by implementing a new electric vehicle tariff policy. Last year, India introduced an EV policy aimed at reducing import duties on EVs from about 70% to 15%, with the government set to start accepting applications under this policy before the end of March, according to domestic news agency IANS. This policy demonstrates India's readiness to support EV manufacturing, as noted by Ammar Master, a South Asia director of automotive at GlobalData, in an interview with CNBC.