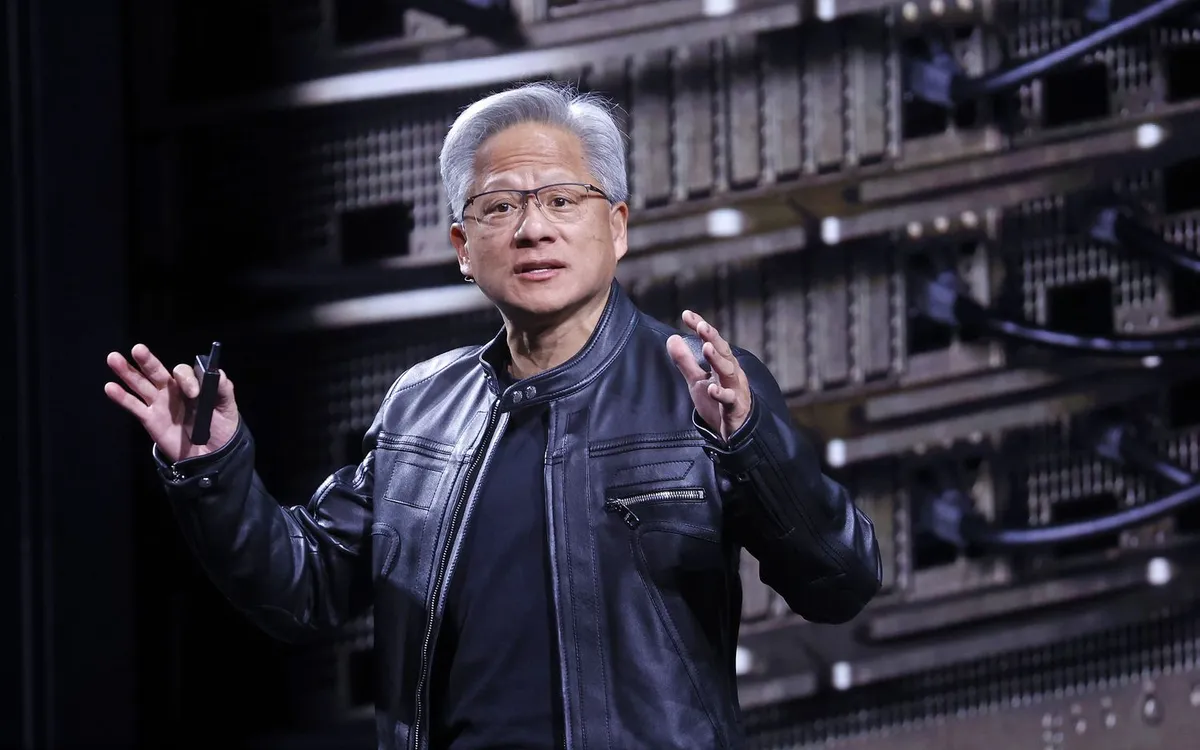

Following a significant rally in U.S. stocks last Friday, driven by increased expectations of an upcoming interest rate cut, investors are now turning their attention to key earnings reports and inflation metrics scheduled for this week. The tech sector, particularly highlighted by Nvidia, the world's most valuable chipmaker, is set to capture the spotlight as it continues to thrive amid the booming AI industry.

Nvidia is expected to release its second-quarter earnings on Wednesday, and analysts are eager to see if the company maintains its leadership in the rapidly evolving AI market. Despite facing challenges from China export curbs, analysts predict that Nvidia will achieve another record in sales. Earlier this year, Nvidia announced that it anticipates increased revenue but cautioned about a potential $8 billion impact due to restrictions on exports to China.

Investors will be keen to hear more about Nvidia's strategies regarding its business in China. The company recently negotiated an agreement with the Trump administration to share revenue from AI chip sales in the region. Moreover, Nvidia is exploring the introduction of a range of new products tailored for the Chinese market, pending government approval.

In addition to Nvidia, several other influential companies are set to release their earnings this week, including Marvell Technology (MRVL), Dell Technologies (DELL), CrowdStrike (CRWD), Snowflake (SNOW), and Autodesk (ADSK), along with a selection of Canadian banks.

This week will also witness the release of crucial inflation data, with the Personal Consumption Expenditures Index (PCE) for July scheduled for Friday. This report follows dovish remarks from Federal Reserve Chair Jerome Powell, which have heightened anticipation for a possible interest rate cut in September. The previous PCE report for June indicated a slight increase in inflation, but subsequent reports suggested that July's inflation rates were lower than expected.

The PCE is the Federal Reserve's preferred measure of inflation, making its findings particularly significant as the central bank approaches its September interest rate decision. Alongside the PCE, this week will feature a series of consumer surveys, data on the U.S. trade balance, and insights into the housing market.

Here’s a look at the significant events and earnings reports to watch this week:

Stay tuned for further updates as these key events unfold, which could significantly impact market trends and economic forecasts.