Gold, often regarded as a safe-haven asset during times of economic turmoil, is experiencing a remarkable surge at the same time the stock market is reaching new heights. This unusual dynamic has raised concerns among market insiders and prompted questions about the underlying factors driving this shift.

The recent rally in gold prices signifies a growing desire among investors to diversify their portfolios away from dollar-denominated assets. As trust in the U.S. economy gradually declines, many are turning to gold as a more stable investment option. On Tuesday, gold futures surpassed a record high of over $4,000 an ounce for the first time, setting the stage for the metal's best performance since 1979—a year marked by double-digit inflation, a Middle Eastern oil crisis, and geopolitical tensions due to the Soviet invasion of Afghanistan.

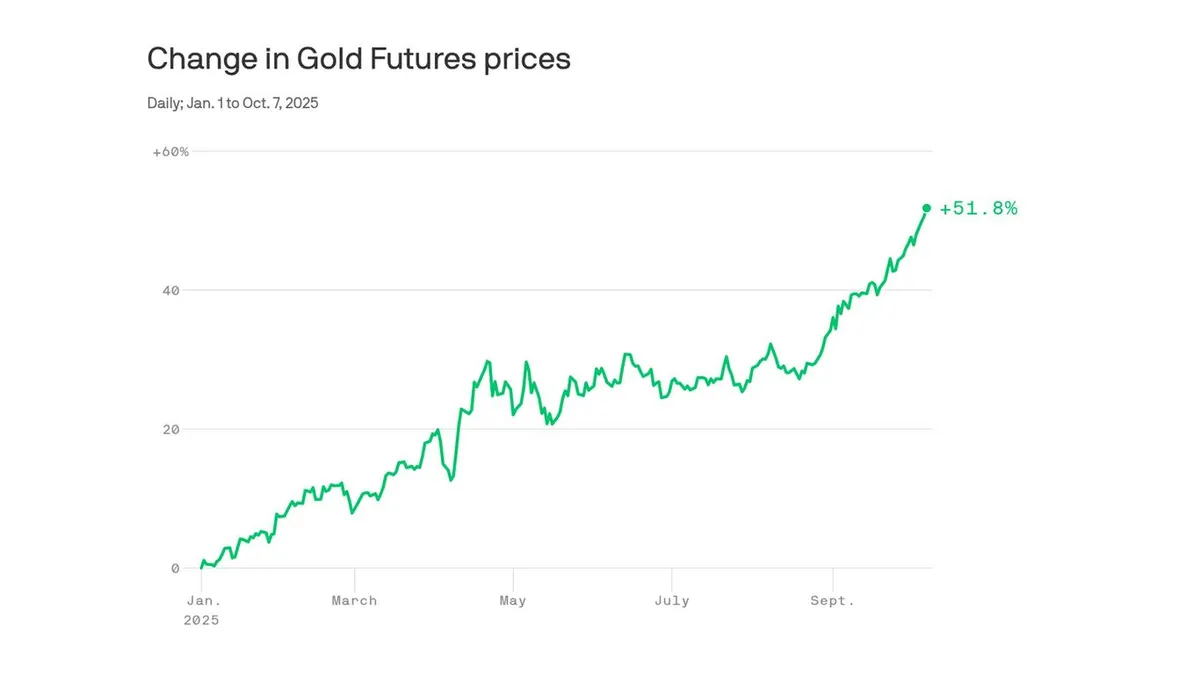

So far this year, the price of gold has surged by an astonishing 51%. According to Mohamed El-Erian, the former CEO of asset management firm Pimco and the current president of Queen's College, Cambridge, investors are demonstrating a tendency to invest in U.S. enterprises while simultaneously hedging against economic instability. This sentiment is echoed by Ryan McIntyre, a senior managing partner at Sprott, who notes that a growing number of people are reassessing their perceptions of what constitutes a safe investment.

The rally in gold is occurring amidst significant economic challenges, including President Trump's trade war and the ongoing government shutdown. El-Erian emphasizes that the U.S. is "weaponizing the tools of economic policy," which could lead to a gradual erosion of confidence in what has traditionally made the U.S. economy exceptional. Despite the surging gold prices and the rising stock market, the U.S. dollar has depreciated by over 9% against a basket of other currencies this year, indicating that while investors are attracted to corporate resilience, they are wary of the risks associated with sovereign assets.

Another significant factor fueling the gold rally is the behavior of central banks worldwide. Many are looking to diversify their reserves after becoming overly reliant on the U.S. dollar. El-Erian highlights that these central banks possess substantial purchasing power, which can significantly influence gold prices. As central banks increase their gold holdings, speculators are drawn into the market, further escalating the price. McIntyre adds that, historically, U.S. Treasuries were the go-to safe haven for investors; however, the current landscape shows that gold has emerged as the primary alternative.

Concerns surrounding potential inflation resurgence, the escalating debt burden of the U.S., and broader economic uncertainties are prompting investors to seek assets like bitcoin and gold, which are not tied to fiat currencies. These dynamics indicate a shift in investment strategies as individuals look beyond traditional financial systems for safety.

Despite these trends, Jay Barry, managing director and global rates strategist at JPMorgan, cautions against labeling the situation as strict de-dollarization. He points out that there is still strong demand for U.S. Treasuries from foreign banks, suggesting that confidence in the dollar remains intact for the time being.

As the Trump administration navigates the complexities of the current economic landscape, it will be crucial to monitor whether the administration perceives the ongoing gold rally, coupled with the dollar's decline, as a potential risk to the economy. Investors will be watching closely to see how these dynamics evolve in the coming months.