The Federal Reserve is anticipated to adopt a cautious stance during its upcoming meeting, choosing to maintain current interest rates despite the pressures of rising prices and a decelerating economic landscape. This decision is expected to further fuel tensions with former President Donald Trump, who has been vocal about his discontent with the Fed’s monetary policies. Central to this friction are Trump’s proposed tariffs, which he plans to implement more broadly starting April 2, 2023.

The White House asserts that these protectionist policies will revitalize American manufacturing and decrease reliance on foreign imports. However, many economists warn that Trump's aggressive tariff approach could trigger a prolonged global trade war, potentially inflicting substantial damage on the U.S. economy. The latest forecast from Fitch Ratings has already downgraded the U.S. growth outlook for the year from 2.1 percent to a mere 1.7 percent, citing Trump's tariffs and the accompanying "huge uncertainty" as significant factors contributing to a potential economic slowdown and temporary price increases.

This environment of uncertainty is likely to impede any rate cuts from the Fed, further straining the already tenuous relationship between Trump and Jerome H. Powell, the Fed Chair appointed by Trump in 2017. During his presidency, Trump labeled Powell as the “enemy” and criticized the Fed governors, calling them “boneheads,” in an attempt to influence their decisions on interest rates. Trump has previously hinted at the possibility of dismissing Powell, raising concerns about the political independence of the Fed.

After the Fed opted to hold rates steady at its last meeting, Trump reiterated his belief that Powell and the Fed had “failed to stop the problem they created with inflation.” In a post on Truth Social, he claimed that if the Fed had focused less on social issues and more on economic factors, inflation would not have become a concern. Currently, the pressing question is when, and if, the Fed will be able to resume interest rate cuts this year.

Market analysts closely monitor the Fed’s quarterly Summary of Economic Projections, particularly the dot plot, which illustrates policymakers' forecasts for interest rates through 2027. Each dot represents an individual Fed official's estimate, and the median dot is viewed as the clearest indication of future interest rate trends. The Fed aims for two primary objectives: maintaining low, stable inflation and fostering a robust labor market. When inflation levels rise, the Fed typically increases interest rates to cool economic activity, thereby controlling price growth.

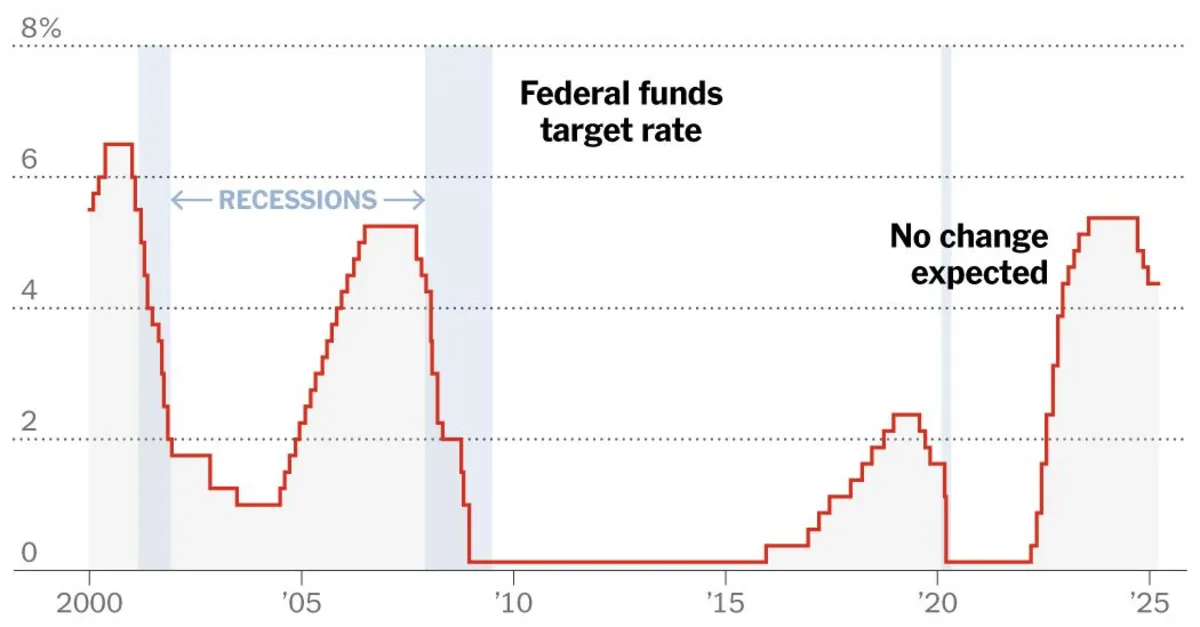

Following a series of rate hikes that began in March 2022 and continued until mid-2023, the Fed has since started reducing rates, with a significant half-percentage-point cut initiated in September 2023. As of now, interest rates stand between 4.25 percent and 4.5 percent, with economists predicting one or two additional quarter-point cuts within the year.

While inflation rates have receded since their peak in 2022, they remain above the Fed's target of 2 percent. The uncertainty surrounding Trump's tariffs raises concerns regarding the Fed’s progress toward its inflation goals. As of January, the core personal consumption expenditures price index, which excludes volatile food and energy prices, was projected at 2.6 percent; Fed officials may raise these estimates in light of Trump's tariff plans.

Despite the labor market's resilience, there are growing fears about economic growth. The Fed's previous growth expectations of 2.1 percent for 2023 could be lowered in the upcoming projections, while unemployment forecasts may rise due to potential federal workforce reductions and spending cuts under Trump’s administration. Many Americans are already expressing concerns about the economy, fearing that the instability surrounding trade policies will deter business investments and hiring.

Investors remain focused on the Fed’s ability to navigate this complex landscape of declining growth expectations and rising recession fears. As of early March, market forecasts indicated that the Fed may not cut interest rates until July, a shift from earlier expectations of June. However, market interest rates have begun to decrease on their own, leading to lower costs for loans such as mortgages and auto financing, effectively mimicking the results of a Fed rate cut.

The recent declines in interest rates have not translated into increased stock prices, as the market reacts to concerns over economic fundamentals. Major corporations, including Delta Air Lines and Macy’s, have reported that consumers are struggling, and recent retail sales data fell short of expectations. The Federal Reserve Bank of Atlanta's growth forecast for the first quarter currently stands at a negative 2.4 percent, highlighting the urgent need for clarity from the Fed.

As the Fed prepares to announce its decision on interest rates and release new economic projections, many are awaiting signals of its future policy direction. With economic conditions shifting rapidly and uncertainty surrounding Trump’s trade policies, the Fed’s strategy will be under close scrutiny. Should officials indicate heightened concerns about the economy or adjust their interest rate forecasts, it could lead to significant market reactions, further influencing the outlook for economic growth and inflation in the United States.