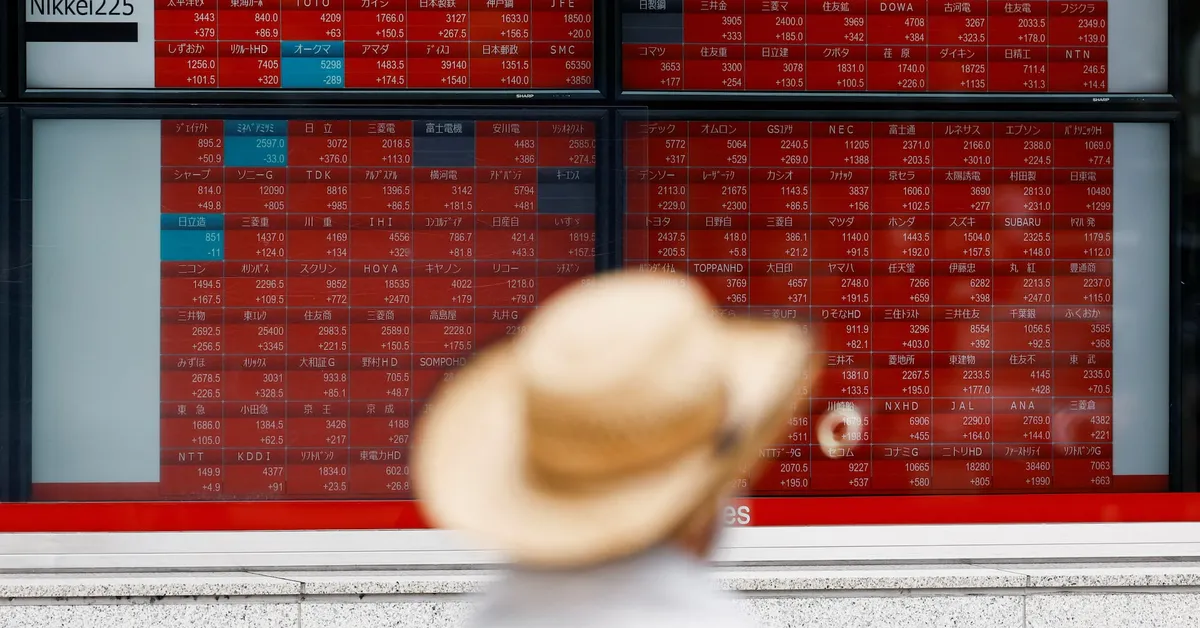

SYDNEY, Sept 12 (Reuters) - Asian share markets experienced a significant upswing on Friday, closely following the positive momentum from Wall Street. The surge was largely driven by growing expectations of rapid U.S. rate cuts, which are anticipated to lower borrowing costs globally. This development has provided relief to stressed bond markets and exerted downward pressure on the dollar.

The optimism from the Asian markets quickly spread to Europe, with major indices like the EUROSTOXX 50, FTSE, and DAX futures all rising by 0.2%. Meanwhile, the S&P 500 futures and Nasdaq futures remained stable, having recently reached new peaks. Notably, stock indexes in Japan, South Korea, and Taiwan are either at or near record highs, while Chinese stocks have hit a remarkable 3.5-year high, spurred by soaring expectations for earnings growth related to artificial intelligence (AI).

The latest U.S. consumer price report was viewed as the final major hurdle for the Federal Reserve to initiate interest rate cuts next week. Fortunately, the report proved to be non-threatening, albeit slightly firm. Analysts at Citi noted that costs in the Consumer Price Index (CPI), particularly those contributing to the Fed's preferred measure of core personal consumption expenditures (PCE), were on the softer side. This led them to predict a steady reading of 2.9% for August.

According to Veronica Clark, an economist at Citi, "It’s an encouraging reading for Fed officials preparing to engage in a series of rate cuts." Citi continues to forecast a total of 125 basis points of rate cuts over the next five FOMC meetings, with an increasing likelihood that the Fed may further reduce rates below 3%. Currently, market expectations imply a 100% probability of a quarter-point cut to a range of 4.00%-4.25% next week, with around a 90% chance of two additional cuts later this year.

The Treasury market has already started to respond favorably, with 10-year yields decreasing by 20 basis points over the past two weeks. This decline effectively acts as a rate cut, as mortgage rates are closely tied to these yields. Consequently, the drop in yields has alleviated some concerns in other significant bond markets, particularly in Europe, which are currently grappling with political uncertainties and increasing fiscal burdens.

In the currency markets, the dollar traded at 147.40 yen, having previously peaked at 148.20 during the last session. On Friday, finance ministers from both Japan and the U.S. issued a joint statement reaffirming that neither country would target currency levels as part of their economic policies. The euro remained steady at $1.1728, receiving a slight boost on Thursday when the European Central Bank (ECB) opted to keep rates unchanged, indicating a strong position on policy.

Greg Fuzesi, an economist at JPMorgan, commented, "This suggests the Governing Council is not inclined to ease in the absence of a large growth shock." He noted that the ECB has postponed its forecast for a final rate cut from October to December, acknowledging that while the ECB may be finished with cuts, ongoing downside growth risks and inflation trends still warrant an easing bias.

Post-meeting sources from the ECB indicated that the December meeting would present the most realistic opportunity to discuss potential further cuts aimed at supporting the economy. Current market assessments suggest only a one-in-five chance of a December easing, with approximately a 60% probability that the ECB has concluded its rate cuts for this cycle.

In the commodity markets, gold prices firmed by 0.5%, reaching $3,654 an ounce, just shy of its record high of $3,673.95 recorded earlier in the week. Conversely, oil prices faced downward pressure following a prediction from the International Energy Agency, which forecasted an even larger record oil surplus for the coming year as OPEC continues to increase production. As a result, Brent crude prices fell by 0.6% to $65.91 per barrel, while U.S. crude dropped by 0.8% to $61.88 per barrel.

Reporting by Wayne Cole. Editing by Shri Navaratnam and Kim Coghill.